Long-term export underperformance underscores the need to address Canada’s and B.C.’s competitiveness problems

New analysis from the Business Council of B.C. shows that Canada’s and B.C.’s share of exports has fallen steadily over the past 20 years, compared with OECD countries, reflecting a challenge with their capacity to compete and expand the sales of services and goods in international markets.Why does this matter? For a small, trade-dependent economy such as Canada’s, exporting products and services to other jurisdictions delivers wide-spread benefits across the economy. This declining share negatively affects our competitiveness and investment climate.Download the report

Two-minute brief

Canada and B.C. have competitiveness problems

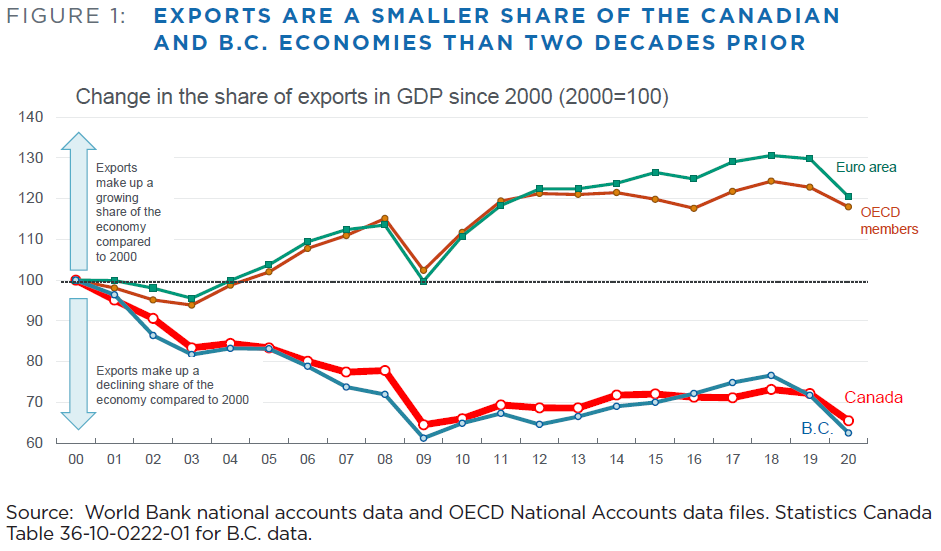

Compared with OECD countries and the Euro area, Canada’s and B.C.’s share of exports in GDP has fallen steadily since 2000, reflecting an underlying challenge with their capacity to compete and expand the sales of services and goods in international markets. A falling share of exports in GDP means the value of exports has grown more slowly than the total value of economic output in the economy, with the proportion of economic benefits and wealth flowing from exporting activity diminishing over time.

For a small, trade-dependent economy such as Canada’s, exporting products and services to other jurisdictions delivers wide-spread benefits. It generates income to fund the purchase of the vast array of imported consumer products and business inputs from other countries. It expands a sector’s/businesses potential market, allowing companies and industries to scale up in size and sophistication. And it creates important spinoff benefits: exporting companies purchase services and other inputs from domestic businesses.Despite NAFTA providing unfettered access to the world’s largest market, Canada signing other bi-lateral and multi-lateral trade agreements, and global trade growing to the benefit of almost every other advanced economy, the relative importance of Canada’s and B.C.’s export sectors fell over the past two decades.The roots of the decline are broad and include a deteriorating competitive position, and limited attention to the reality of competitiveness challenges and the need to build export capacity. The exchange rate, commodity cycles and prices (particularly energy), and U.S. business cycle economy are relevant cyclical considerations. But the duration and magnitude of Canada’s (and B.C.’s) export underperformance and the fact it differs so dramatically from other wealthy countries suggests structural factors, including competitiveness and investment climate, are probably important.Governments must first recognize Canada has a serious problem and then immediately begin working on improving Canada’s competitiveness and investment climate.Download the report