After years of weak business capital spending, Canada needs an investment turnaround – is one coming?

The last few years have seen a cascade of reports and studies examining trends in business investment in Canada. Think tanks like the C.D. Howe Institute and the Fraser Institute as well as the Bank of Canada have analyzed how Canada compares to other advanced economies in “capital formation” – i.e., investments in a range of assets that make companies and their employees more productive and innovative.[1] Such assets include factories, other production centres, and research & commercialization facilities; all types of equipment and machinery; engineering infrastructure; advanced process technologies; and intellectual property.[2]

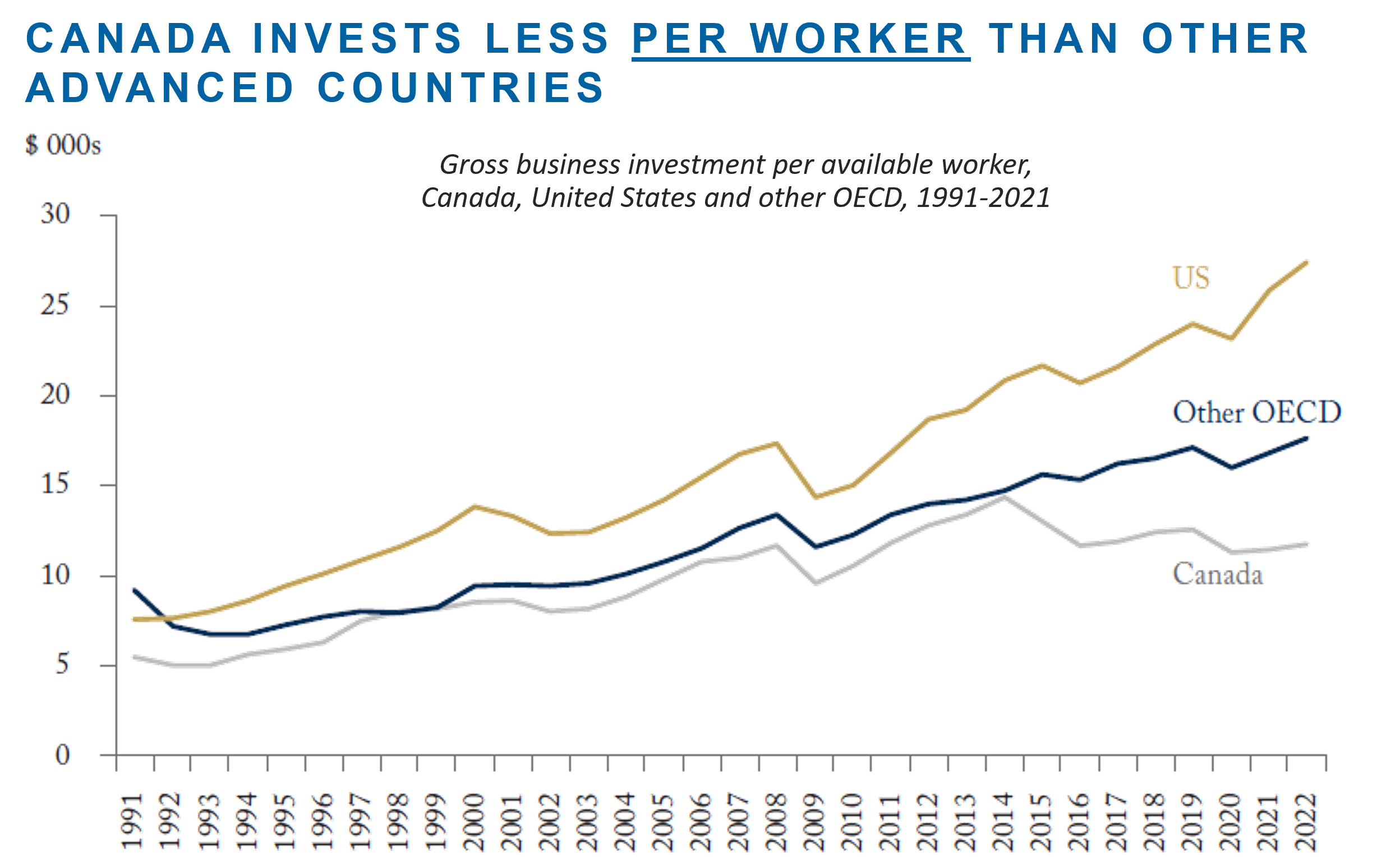

The overall picture that emerges is that during the half-decade leading up to the 2020 COVID shock, Canada was a poor performer on capital spending relative to most peer jurisdictions. Figure 1, based on a recent C.D. Howe Institute study, shows that Canada has been investing far less on a per worker basis in productive capital than our main trading partner, the United States, as well as the typical advanced economy country. The investment per worker gap with the United States has widened alarmingly in the last decade. So too has the cross-border gap in investment in information and communications technologies that are often viewed as critical to productivity growth (Figure 2). All of this suggests that Canada is likely to continue losing ground to the U.S. – and many other advanced economies -- in labour productivity and real wage growth in the coming years.

Figure 1

Source: Robson and Wu, 2021.

Figure 2

Source: Bank of Canada, The role of Canadian business in fostering growth, Remarks by Tiff Macklem, February 9, 2022.Against this somber backdrop, Statistics Canada’s latest survey of 2022 investment intentions and actual investment activity in 2021 offers a few glimmers of light. According to the agency’s survey of Canadian businesses carried out last fall, capital expenditures on non-residential construction and machinery and equipment (M&E) are expected to rise by 8.6% in 2022, on the heels of a 10.4% increase last year when the economy was rebounding from the COVID-induced 2020 recession. In B.C., total capital spending is projected to climb by 7.2% this year, following an 11.1% advance in 2021. These are healthy gains.Looking below the headline numbers leads to a more cautious assessment, however. For one thing, much of the strength in investment in 2022 reflects a surge in public sector capital outlays. Nationally, public sector capital spending is expected to reach a record $117 billion this year, up almost 10% from 2021 and representing about 40% of all investment spending. Two years ago, public sector capital expenditures stood at $93.7 billion. Thus, between 2020 and 2022 investment spending by Canadian public sector organizations is on track to grow by roughly one-quarter.

Business investment is also on the rise, but not to the same extent. By industry, the strongest growth in Canadian private sector investment in 2022 will be in the oil and gas/mining and transportation/warehousing sectors, with smaller increases in store for accommodation and foodservices, real estate/leasing, and information and cultural industries. At the other end of the spectrum, capital spending is expected to decline in agriculture, forestry, manufacturing, and financial services.

For B.C., the pattern is fairly similar. Capital spending is projected to post solid gains in oil and gas/mining and transportation/warehousing, while falling in agriculture and forestry – mirroring the national results. B.C. companies are also expected to boost investment outlays in 2022 in sectors such as manufacturing, financial services, real estate and leasing, and construction.

In the past couple of years – and for at least the next two years – the investment numbers for B.C. are strongly influenced by a handful of unusually large capital projects, including Site C, the TMX pipeline, the LNG Canada facility under construction in Kitimat, and the Coastal Gas Link Pipeline which will ship natural gas to the LNG Canada liquefaction plant. Without these major projects, the underlying trend in capital formation in the province is considerably softer.

While Canada (and B.C.) has seen a pick-up in capital spending in both the public and private sectors since the sharp but brief downturn in 2020, there is still a long way to go to engineer a meaningful turnaround in what has been a disappointing private sector investment track record since the mid-point of the previous decade. Our hope is that creating a more dynamic and attractive environment for private sector capital formation will be the central focus of the upcoming federal government budget.

[1] For example, see William B.P. Robson and Miles Wu, “Canada’s Investment Imperative: Stronger Business Investment – Can We Get It? C.D. Howe Institute, February 2, 2022; Steve Globerman and Joel Emes, An International Comparison of Capital Expenditures, Fraser Institute, August 2021; and the recent speech by Bank of Canada Governor Tiff Macklem, “The role of Canadian business in fostering non-inflationary growth,” Remarks by Tiff Macklem, February 9, 2022.

[2] Investment in home-building and home renovation is not typically included in studies which look at capital formation.