Canada is not generating the income needed to regain our pre-pandemic living standards

Canadian living standards are slipping. You don't have to be an economist to see or feel that intuitively. Whether it’s how far our paycheque stretches after inflation, buying groceries or a home to raise a family, filling up our car during the school run, staring at our mortgage account statements, taking stock of the array of taxes we pay, wanting our child to go to an actual school rather than a makeshift portable classroom (even in newly-opened schools!), or praying we can see a doctor in time to receive the treatment we need, the symptoms of slippage in our living standards are all around.

Our economy is simply not as efficient or productive as it could be, nor is it generating the real income per person needed to sustain our standard of living.

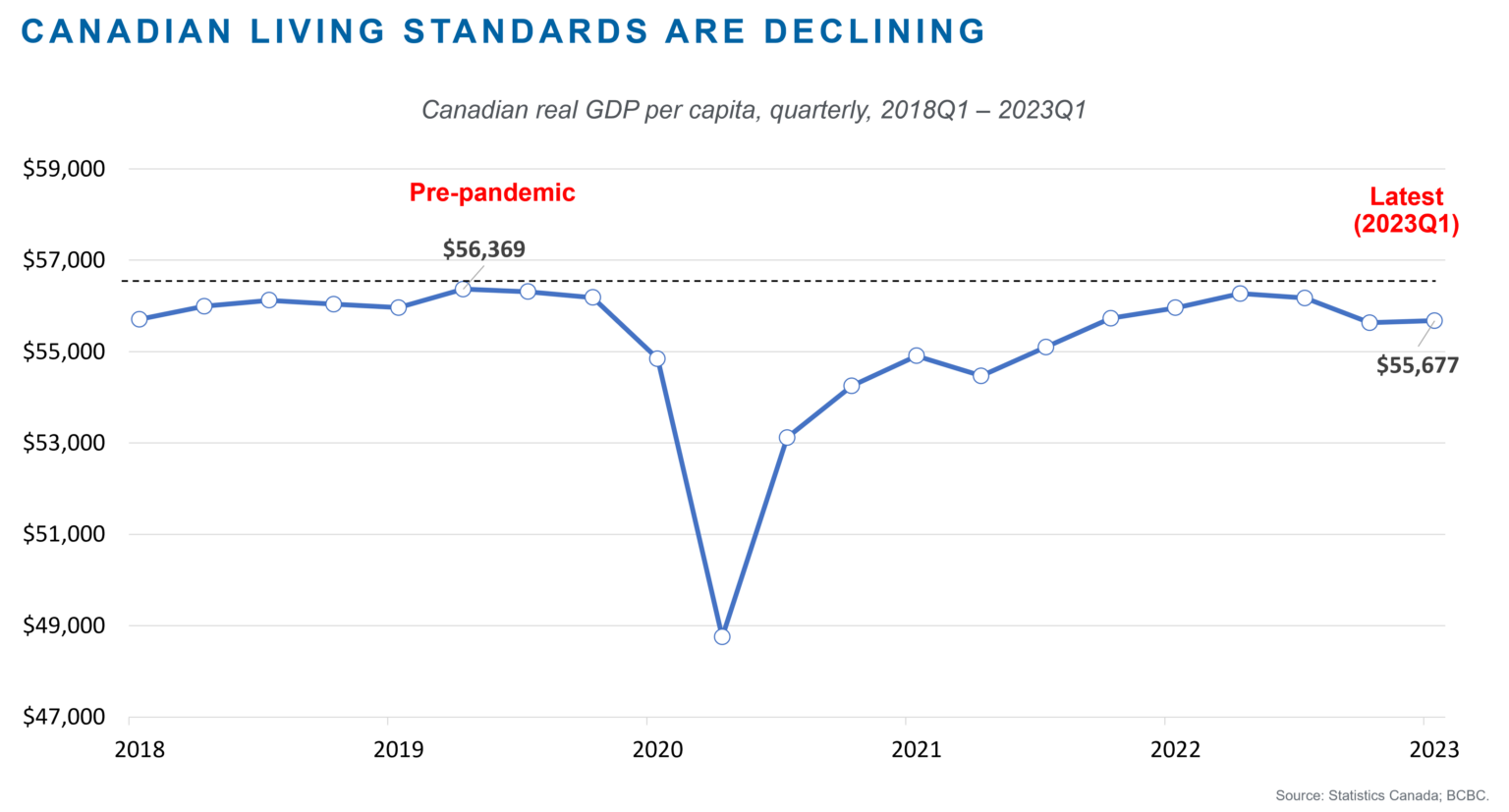

Economic data confirm our experiences on the ground. According to Statistics Canada data for the first quarter of 2023, Canadian real GDP is now $55,677 per person, down by 1.2% since 2019 (Figure 1). This includes a precipitous drop in 2020 during the pandemic, followed by a weak and incomplete recovery in 2021-22. That partial recovery ran out of steam by the middle of 2022. Canada is one of the few advanced countries not to have recovered its pre-pandemic level of real GDP per capita.

Canada (and B.C. with it) is on track to be the worst performing economy out of 38 advanced countries over both 2020-30 and 2030-60, with the lowest growth in real GDP per person, according to OECD projections (see Williams, 2023a and Williams, 2021).

Figure 1

For “sugar pops” economic policy-making, the music hasn’t stopped, yet – but it is slowing

Today, advanced countries are grappling with runaway inflation even though global supply chain disruptions have been resolved. High inflation follows several years of justifiably massive (during 2020) and then unjustifiably excessive and sustained (during 2021-2022) fiscal and monetary policy support for consumer and housing demand. The St Louis Federal Reserve estimates that, for Canada, 2.5 percentage points of “excess inflation” (defined as annual CPI inflation in February 2022 less the 2015-19 inflation average) was due to domestic fiscal stimulus and another 3 percentage points was due to the indirect effects of foreign fiscal stimulus (especially from the U.S. and Mexico) through import and export prices (see Soyres et al., 2023).

After misjudging high inflation as “transitory,” central banks sharply hiked interest rates to cool demand for goods, services and labour. In other words, they are trying to bring demand into balance with supply. (They are not getting much support from governments who continue to pull in the opposite direction by adding fiscal stimulus to boost demand, however.) Central banks are also unwinding their bloated balance sheets after buying massive quantities of government bonds over 2020-21. Meanwhile, credit ratings agencies stand ready to downgrade government debt ratings if they see fiscal wobbles, resulting in higher public borrowing costs going forward, as recently happened in B.C. (see Finlayson and Williams, 2023).

What does all this mean? The post-pandemic policy environment is unforgiving. The leeway to offer “sugar pops” policies – keeping our economy buzzing on a diet of stimulus and easy credit, while ignoring structural issues (see Williams, 2022 and Williams, 2023b) – is disappearing. This decade, unlike the past decade, we won’t be able to rely on policymakers for loose spending, ultra-low interest rates, endless credit expansion, and rising real resale home prices to make us feel more prosperous.

As living standards slip and stagnate, there may come a time, soon, when policymakers have to address our economy's inefficiencies and its inability to generate gains in real incomes per person.

The music hasn’t stopped, yet – but it has certainly slowed.