Federal migration policy disconnected from housing supply reality

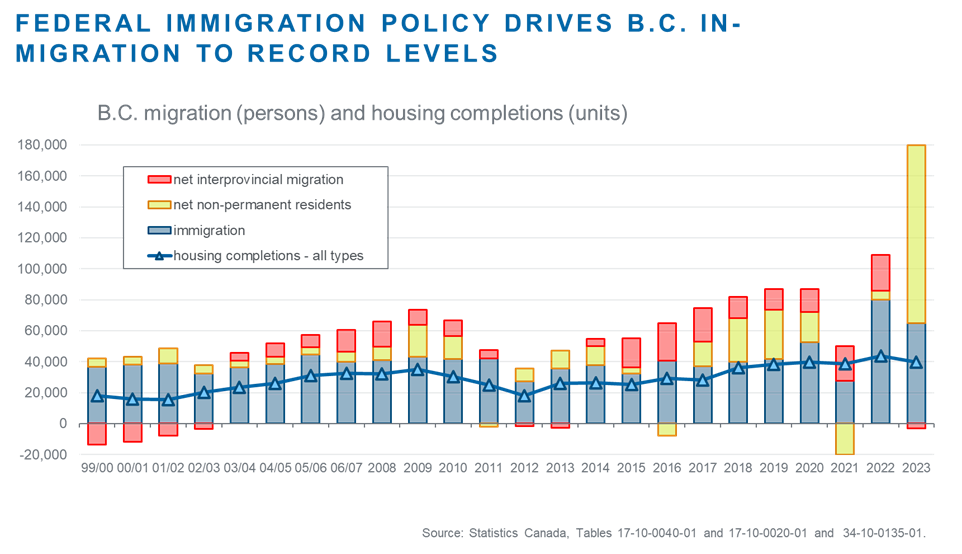

Over the past year an astonishing 180,000 people moved to B.C. from other jurisdictions, a number roughly equivalent to the population of Greater Langley (the City and District combined). During the same period, almost 40,000 new housing units were completed in the province. The housing affordability and rental crisis is complicated and multi-faceted, with a lengthy period of rock bottom interest rates and a massive credit expansion during the pandemic occupying centre stage. But the growing wedge between the number of new homes being built in B.C. and strong population growth fueled by surging in-migration is also playing a starring role in the housing market story.

Permanent and non-permanent international migration to B.C. have both moved sharply higher. Over past year (the four quarters ending in Q1 of 2023), some 65,000 permanent immigrants settled in B.C. Between 2008 and 2018 annual permanent immigration averaged 38,000. Thus, the recent immigration inflow is 1.7 times higher than the decade- average before the pandemic.

Meanwhile, the rise in non-permanent residents, comprised mostly of temporary foreign workers and international students, is even greater. Over the same four-quarter period noted above, the number of non-permanent residents in B.C. jumped by 114,000. The annual net increase in non-permanent residents usually runs around 10,000. Given that the recent inflow is more than 10X the decade long average and that some of this appears to reflect catch-up from earlier pandemic-related disruptions, the non-permanent resident figure should be interpreted with some caution. Nonetheless, even if the recent inflow were half the posted number, it would still be eye-catching and well above historic norms.

Figure 1

Interprovincial migration recently turned negative and has been dampening overall population growth in British Columbia. The net outflow of 3,000 interprovincial migrants over the four quarters to Q1 2023 is tiny compared to the magnitude of international inflows. But the tempering impact on population growth is more significant considering that B.C. normally attracts a net inflow of around 10,000 interprovincial migrants annually and had a net inflow of more than 20,000 in each of the previous two years. The increase in the number of British Columbians moving out of the province has resulted in a swing of interprovincial migration that has trimmed population growth by 25,000. Amid the ongoing housing affordability crisis, mounting stresses in the rental market, and lots of job opportunities in other provinces (link to jobs blog), we believe the net interprovincial outmigration numbers will accelerate over the next year or two.

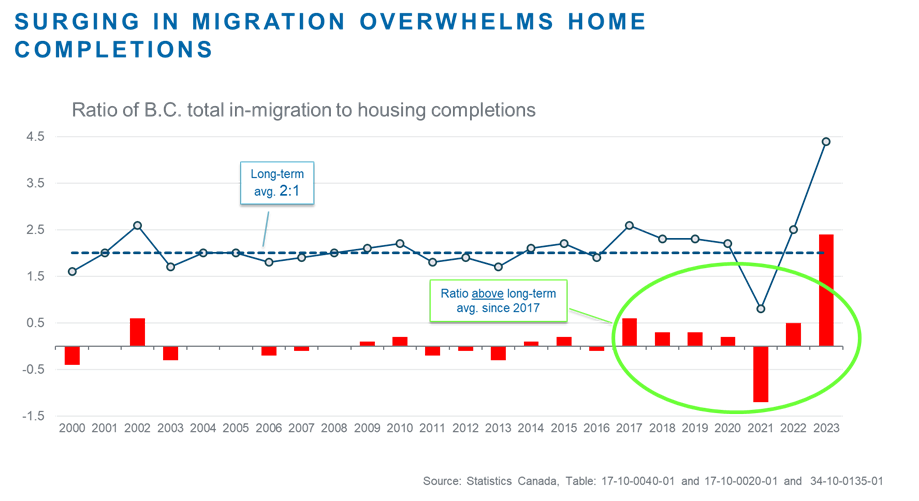

Figure 2

The ratio of total in-migration to new B.C. home completions was remarkably stable over the past three decades -- until recently. Since 1991, total in-migration from all sources has averaged 56,000 while new home completions have averaged 28,000. Even as the mix of permanent immigrants, net-non permanent residents and net interprovincial migrants changed over time, this ratio didn’t shift much, remaining anchored around 2:1. But in 2017 this ratio moved above its long-term average and it has stayed there ever since (except during the pandemic). Between 2000 and 2016, the ratio of net in-migration to home completions exceeded 2:1 on just five occasions -- and never for more than two consecutive years. In 2023, the ratio of in-migration to home construction surged to previously unheard of 4.4:1.

Figure 3

The duration and magnitude of the deviation in the ratio of total in-migration to home completions from its long-term average is striking. It suggests that upward pressure on rents will persist and perhaps intensify in the years ahead. Population growth will also pour more fuel on the home price fire -- even as higher interest rates have pushed B.C.’s unaffordability metrics into uncharted territory.

As many industry analysts have noted, a significant and sustained expansion in housing supply is badly needed, encompassing all segments of the market, including rental units as well as market and non-market housing. Given B.C.’s current population trends, the current rate of home completions is not the right level. But building activity is already elevated, and the gap between population growth and new homes continues to widen. B.C. does not have the capacity to build our way to more affordable housing in the near-term. Even if the number of non-permanent residents retreats from the current sky-high levels and interprovincial outflows accelerate over the next year, the reality is that total in-migration will continue to outstrip new home construction by historic margins, while also adding to pressures on public sector and other infrastructure services.

Too much population growth is not something to be welcomed. And amid the province’s ongoing housing supply and affordability woes, our rapidly growing population can be expected to cause more growing pains.