Incomplete, superficial and unbalanced: Assessing Canada’s “economic recovery” since the pandemic

The Trudeau government’s 2022 Fall Economic Statement triumphantly claims on page 6 that “Canada’s economic recovery from the pandemic recession has been strong.” Elsewhere, on page 27, it offers a further boast: “There is no country better placed than Canada to weather the coming global economic slowdown and thrive in the years ahead.”A closer look at the data shows these claims are shaky at best (Williams, 2022a). Canada’s economic recovery has been incomplete, superficial and unbalanced. And it may be about to come unstuck as a global recession unfolds in 2023. The recession will be unlike the recessions of 2000, 2008 and 2020 and more like the inflation-fighting recessions of the early 1980s and early 1990s.

Incomplete recovery in GDP per person

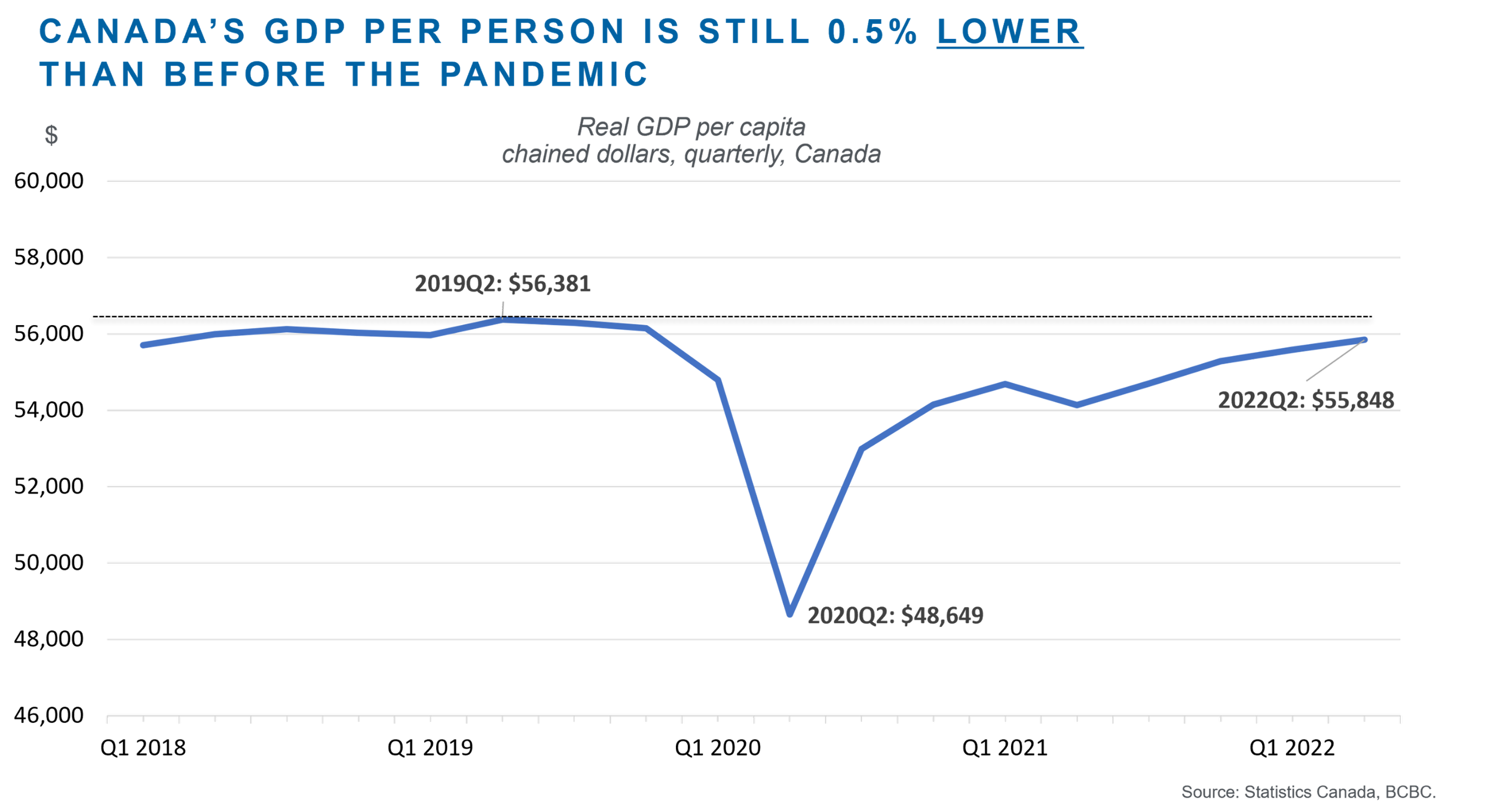

Canada’s economic recovery over 2021-22 was superficial and incomplete. Real annual income of Canadian households and businesses is still lower than in 2019. Real GDP per person fell from $56,400 in 2019Q2 to a low of $48,600 in 2020Q2 (Figure 1). As of 2022Q2, real GDP per person is $55,800 – still 0.5% lower(-$533) than before the pandemic.

Figure 1

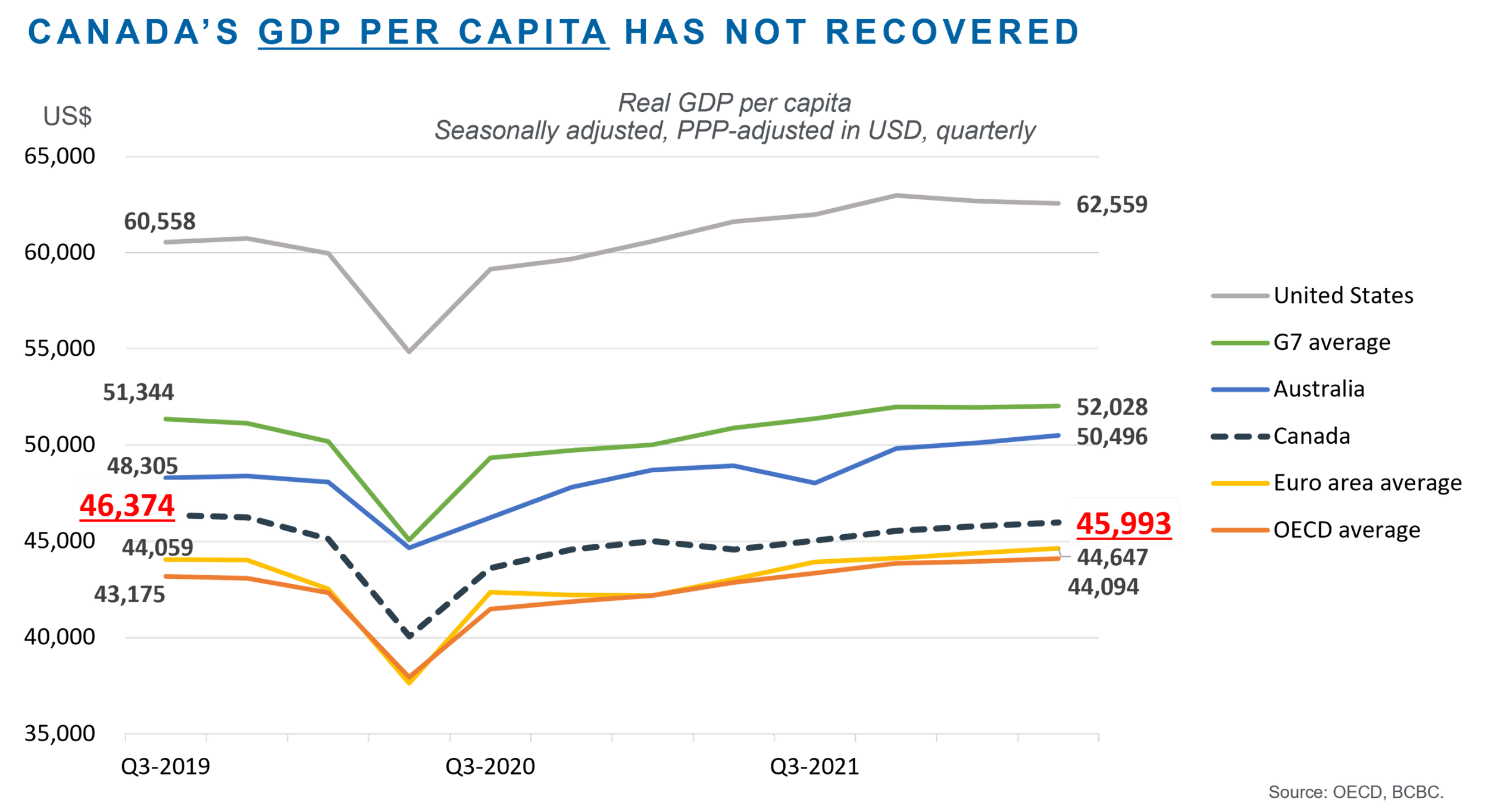

Canada is one of the only advanced countries in the world not to have recovered its pre-pandemic level of GDP per person in 2021 (Figure 2). In contrast, the U.S., the G7 average, the OECD average and Australia all fully recovered and surpassed their pre-pandemic level of real GDP per person in 2021. With a global recession looming in 2023, Canada’s GDP per person is likely to cease its partial recovery and start to fall again (discussed below).

Figure 2

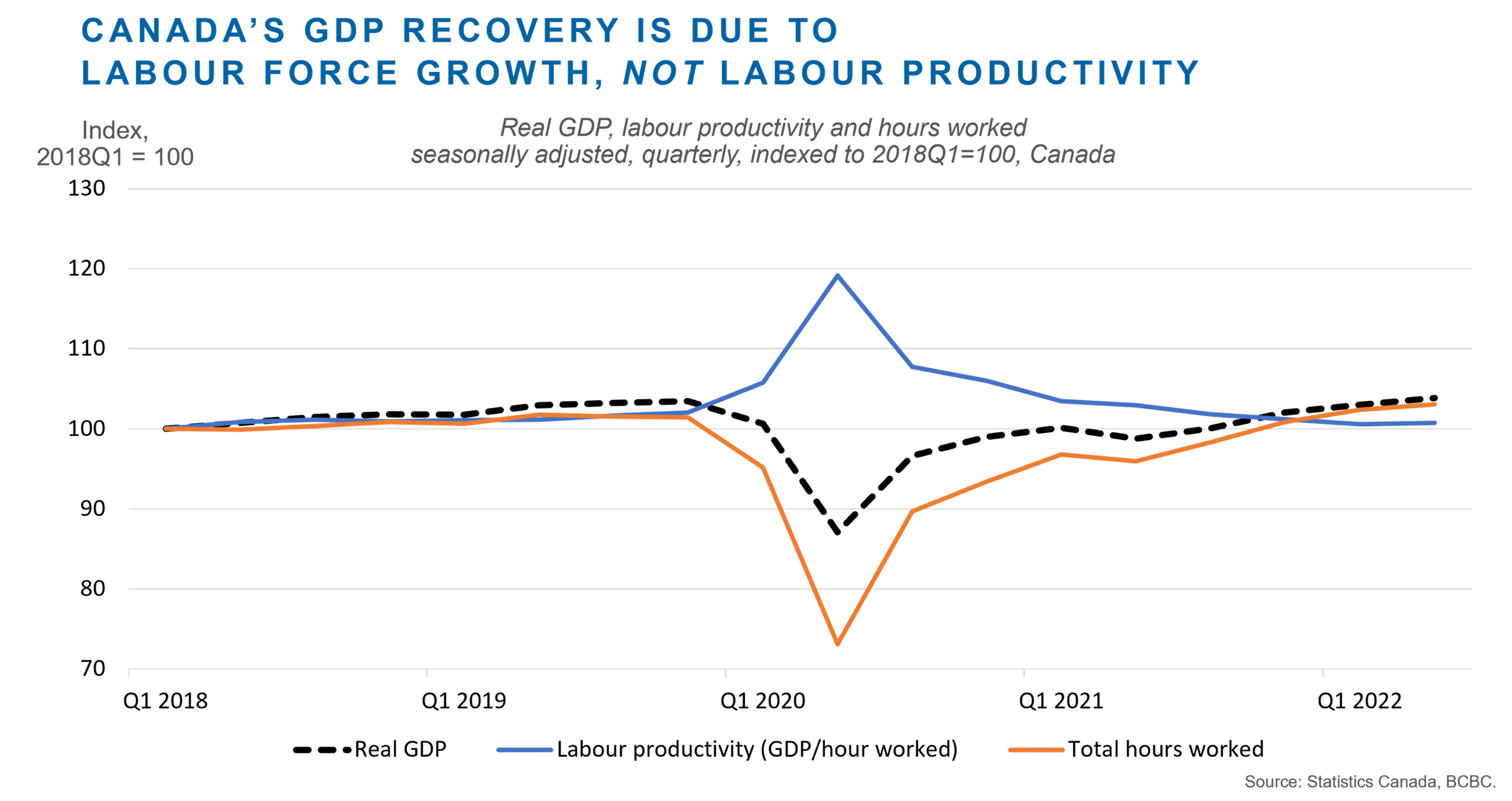

Superficial recovery in GDP

It is true that Canada’s topline GDP is above pre-pandemic levels. However, let’s look at GDP growth from the supply side. All of the recovery in Canada’s GDP has been driven by growth in total hours worked, not labour productivity (Figure 3). Total hours worked has grown due to two factors: sharply falling unemployment rates (evidence of an overstimulated, overheated, inflationary and unsustainable economy;) and robust labour force growth (due to immigration-driven population growth). Higher labour productivity translates to higher real GDP per person; growth in total hours worked does not.

Figure 3

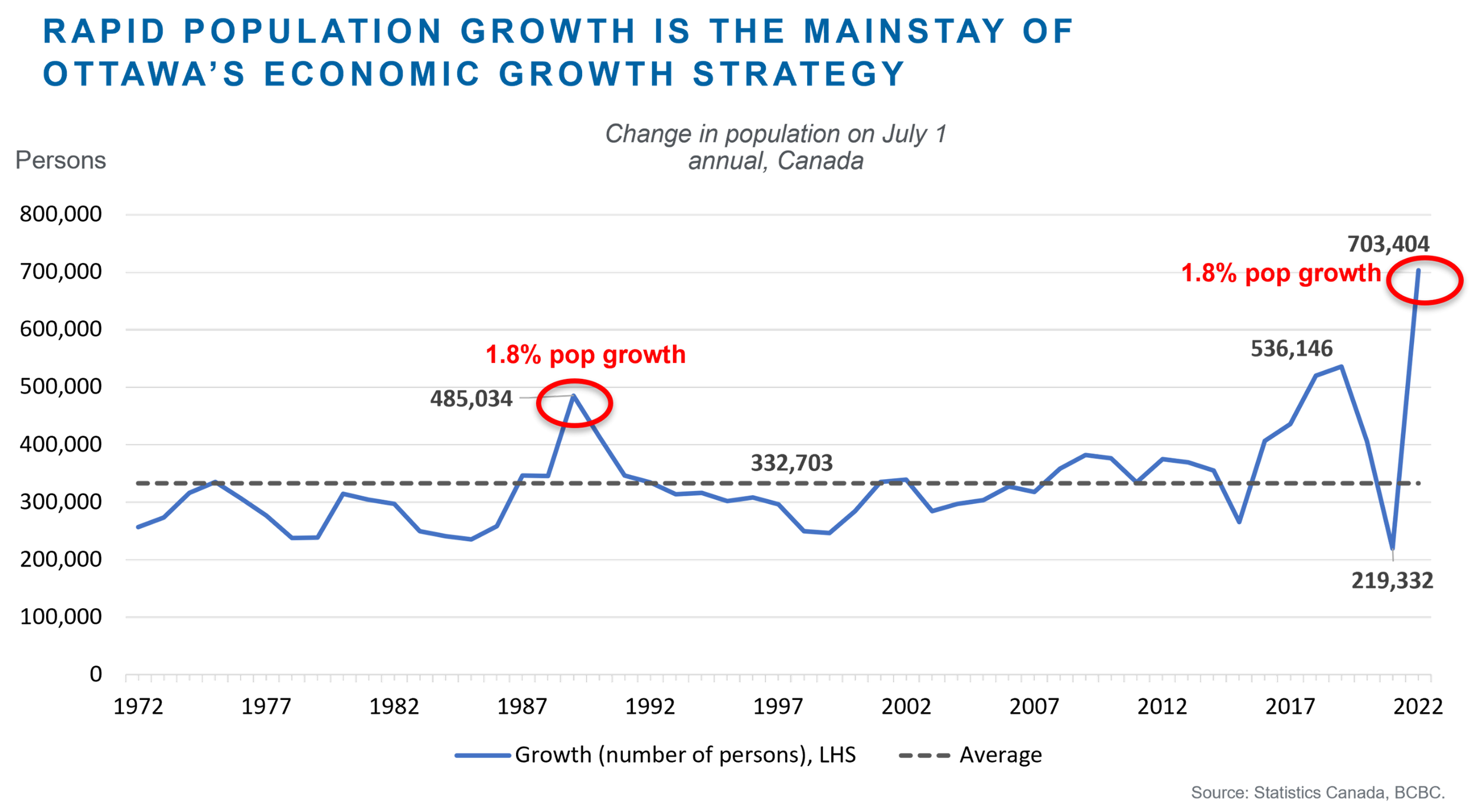

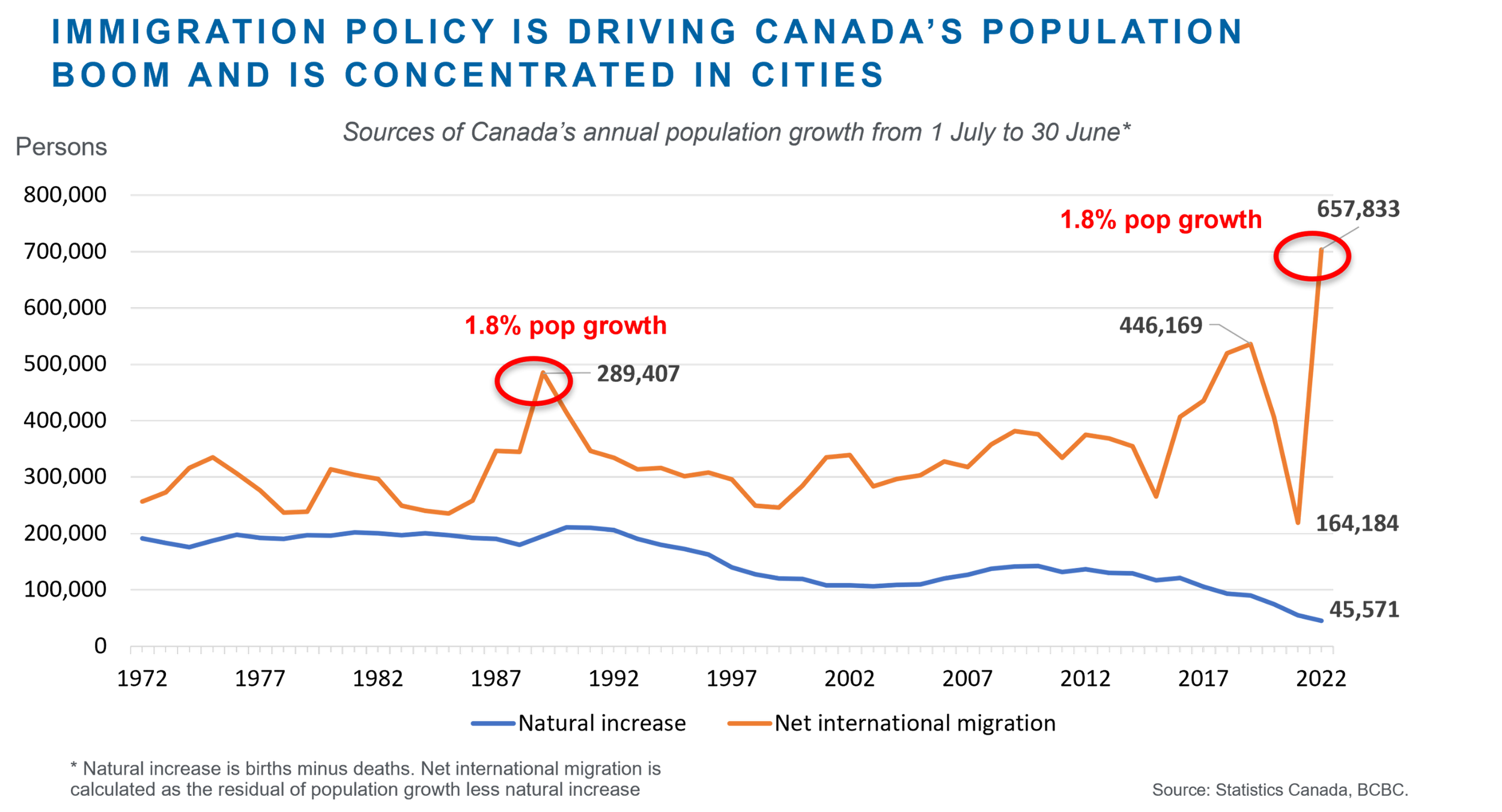

The federal government’s supercharged immigration strategy was largely responsible for a staggering 703,000 person (1.8%) increase in Canada’s population over the past year to July 1st, with most of that population increase concentrated in the major cities (Figure 4). This marked the largest absolute population increase in the country’s history and the fastest growth rate since 1987. Population growth comes from two sources: births minus deaths (“natural increase”); and temporary and permanent immigration net of emigration (“net international migration”). The natural increase in Canada’s population in 2021 was only around 45,000 persons while net international migration added almost 660,000 persons (Figure 5).Therefore, topline GDP did not grow because Canada’s workforce became more productive (i.e., increased value-added produced per unit of labour input). It grew simply because there are more people and workers in the economy, which raised total hours worked. This explains why Canada’s GDP has more than fully recovered from the pandemic but GDP per person has not. Yes, the economy is bigger, but people’s share of the income pie has decreased.

Figure 4

Figure 5

Unbalanced recovery in GDP

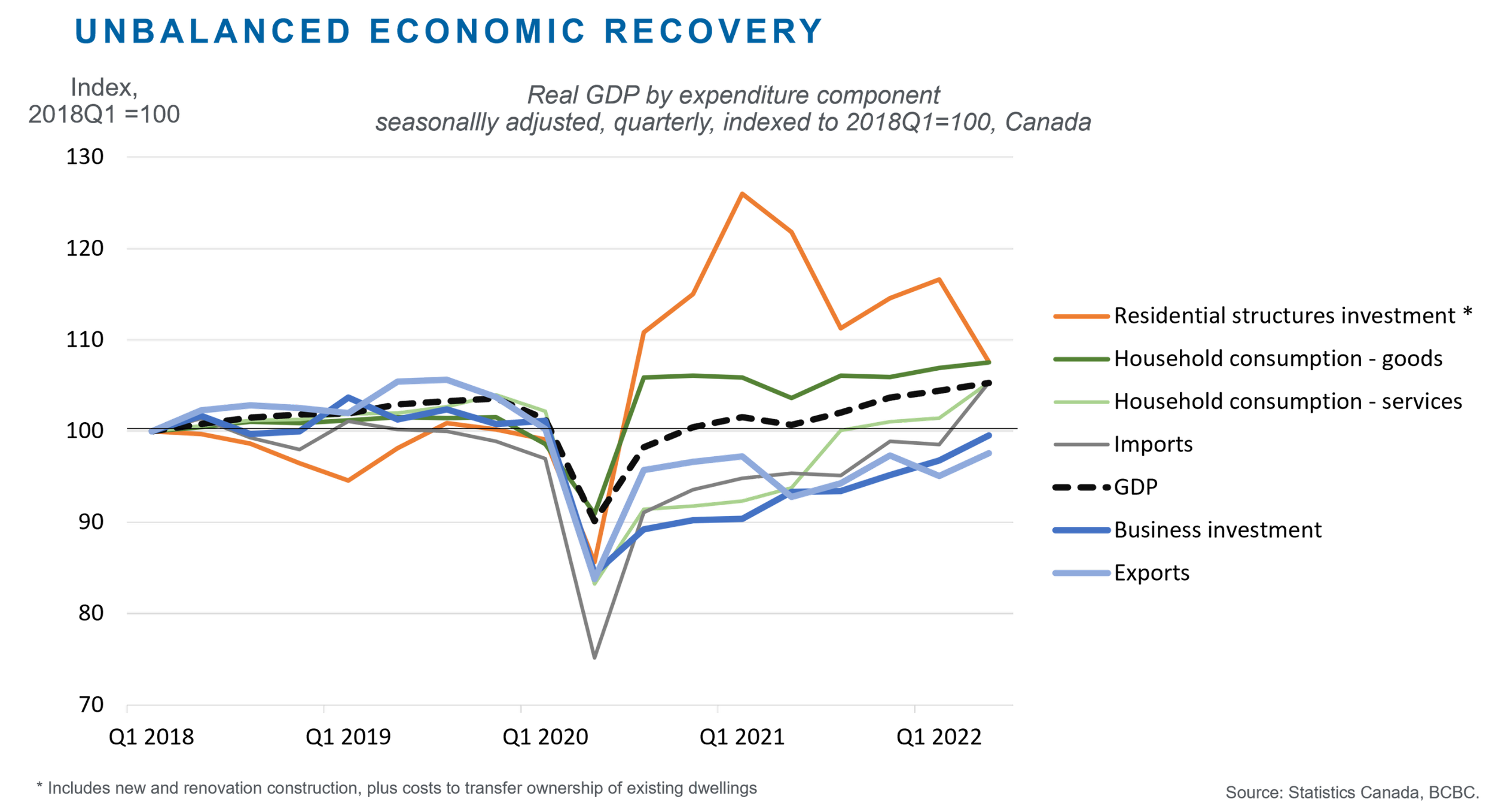

Looking at GDP by expenditure, Canada’s economic recovery was led by wildly overstimulated residential structures investment and household goods consumption (Figure 6) driven in part by massive increases in demand for mortgage credit (Figure 7). While the recovery in services consumption and imports was initially slow due to public health restrictions, they too have surpassed pre-pandemic levels. In contrast, business capital investment and export volumes have languished and are yet to surpass 2019 levels (Figure 6). This is despite an extraordinarily favourable external terms of trade (the ratio of export prices to import prices). High international prices for commodities tell us that the world is calling to buy more of Canada’s export mix – but unfortunately Canada is not picking up the phone.

Figure 6

Figure 7

Unbalanced recovery in employment

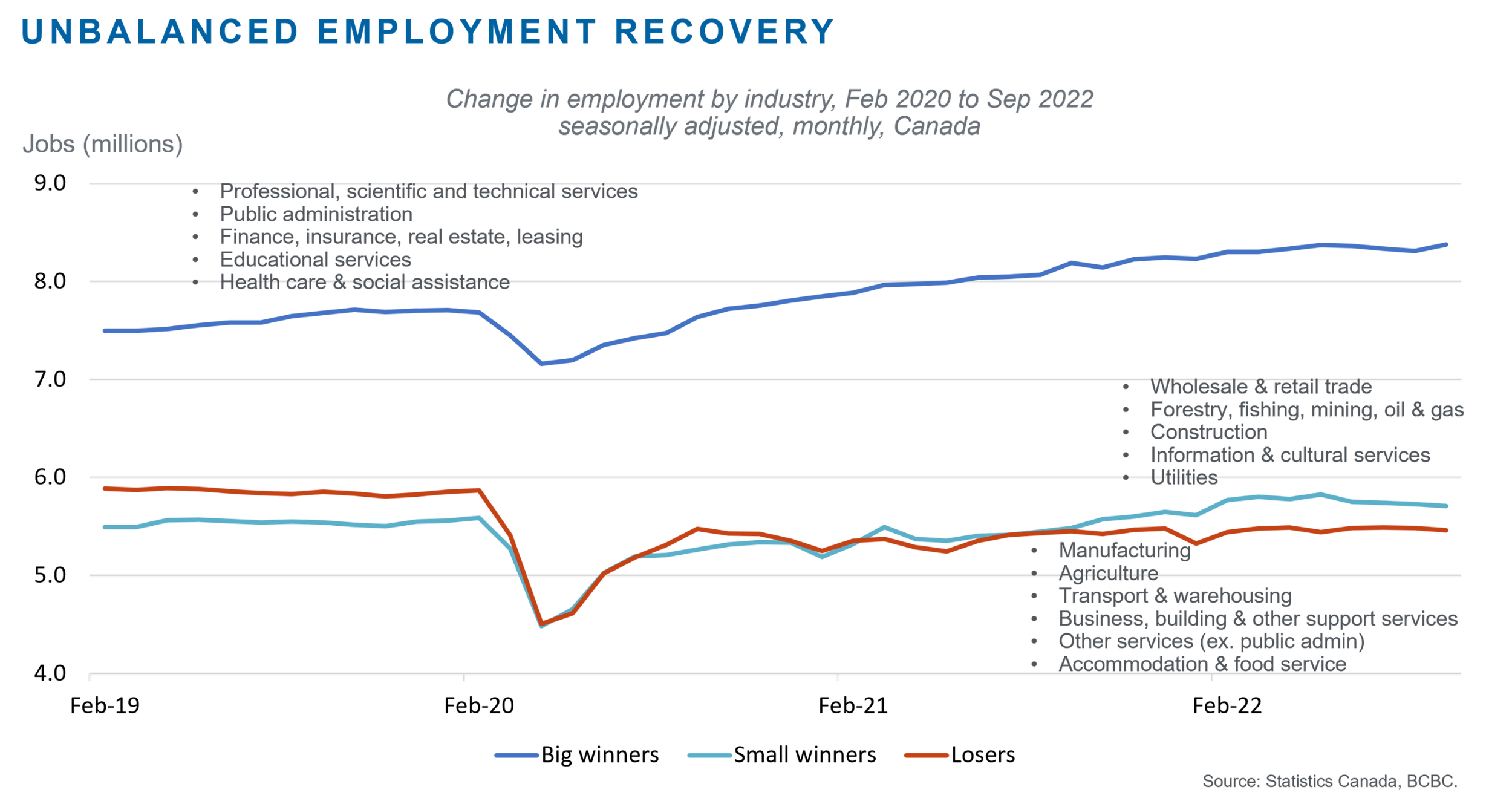

The recovery in the labour market has been concentrated (Figures 8and9). “Big winners” are those industries where employment is well above pre-pandemic levels: professional, technical and scientific services; public administration; finance, insurance, real estate and leasing; education; and health. “Small winners” are those industries where employment is marginally above 2019 levels: wholesale and retail trade; forestry, fishing, mining, oil and gas production; construction; information and cultural services; and utilities. Finally, the “losers” from the pandemic, those industries with lower employment levels than in 2019, are: manufacturing; agriculture; transport and warehousing; business, building and other support services; other services (excluding public administration); and, most of all, accommodation and food service.

Figure 8

Figure 9

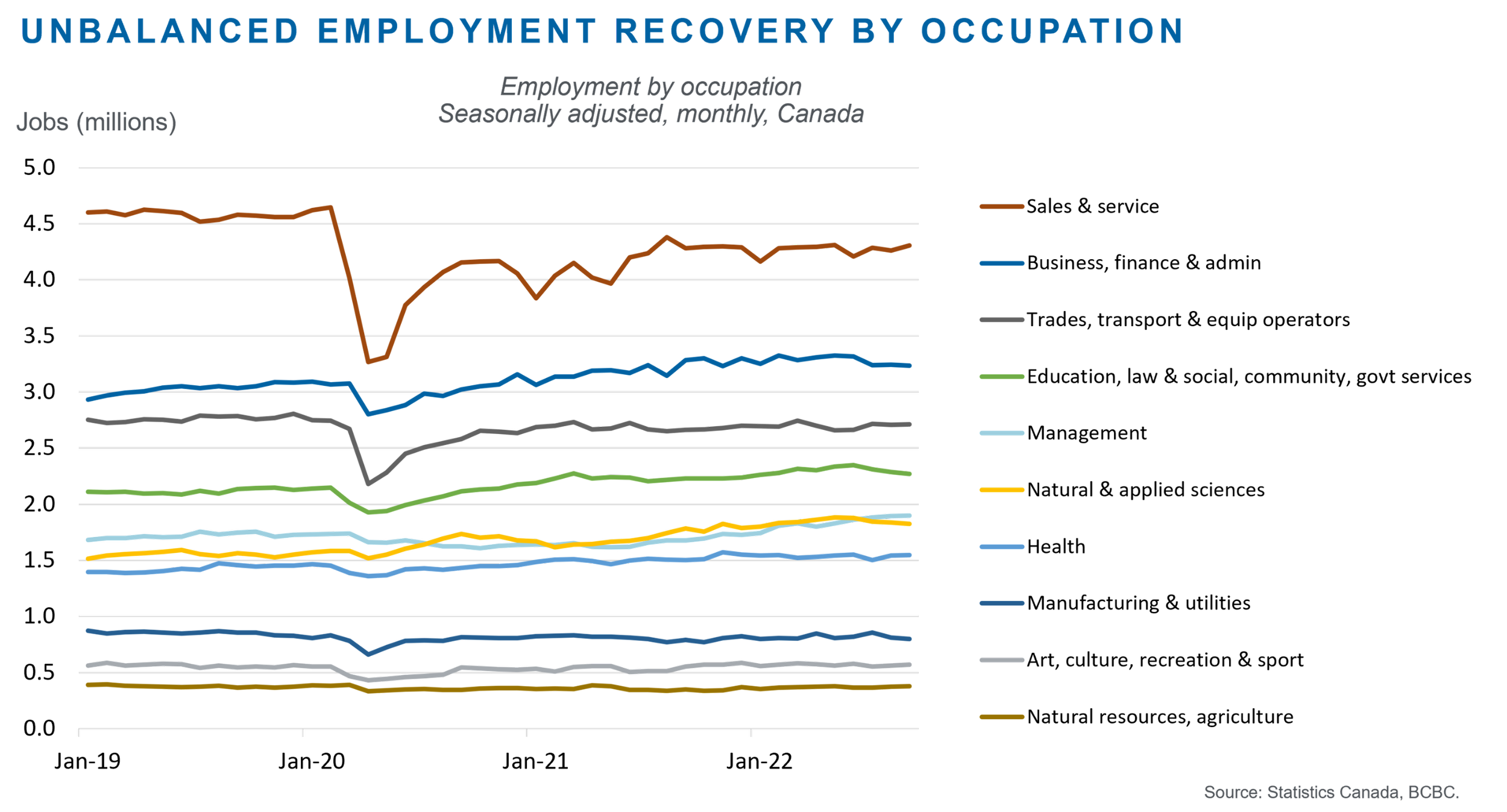

Finally, the labour market recovery has also been unbalanced by occupation. There has been strong growth in employment for occupations in: business, finance and administration; education, law, and social, community and government services; management; and natural and applied sciences. Most other occupations have been fairly flat. The largest and worst-affected occupation group is sales and services. Prior to the pandemic, about 4.6 million Canadians were employed in sales and service occupations compared to about 4.3 million in 2022.

Conclusion: Canada’s economic recovery during 2021-22 has been incomplete, superficial and unbalanced. These are not the characteristics of a “strong” recovery, nor of a country that is supposedly “the best placed in the world” to face a global recession in 2023, as claimed in the federal government's Fall Economic Statement (see Williams, 2022a). Policymakers need to get serious about addressing Canada’s long-ignored structural challenges. Earlier this year business leaders across Canada lamented that the federal government’s policies in recent years have encouraged a “sugar pops” economy (Williams, 2022b). The analogy refers to federal policies that have kept the economy buzzing on a “sugar high” of short-term macroeconomic stimulus and credit expansion but did little to engender long-term prosperity for people through higher labour productivity, business investment per worker, and real income per capita. Delivering long-term prosperity for people, not juicing topline GDP growth with “sugar pops” policies, should be the priority of decision-makers in Canada and B.C. in the years ahead.