Tracking B.C.’s industry employment dynamics through the pandemic – and the public sector’s oversize role in job creation

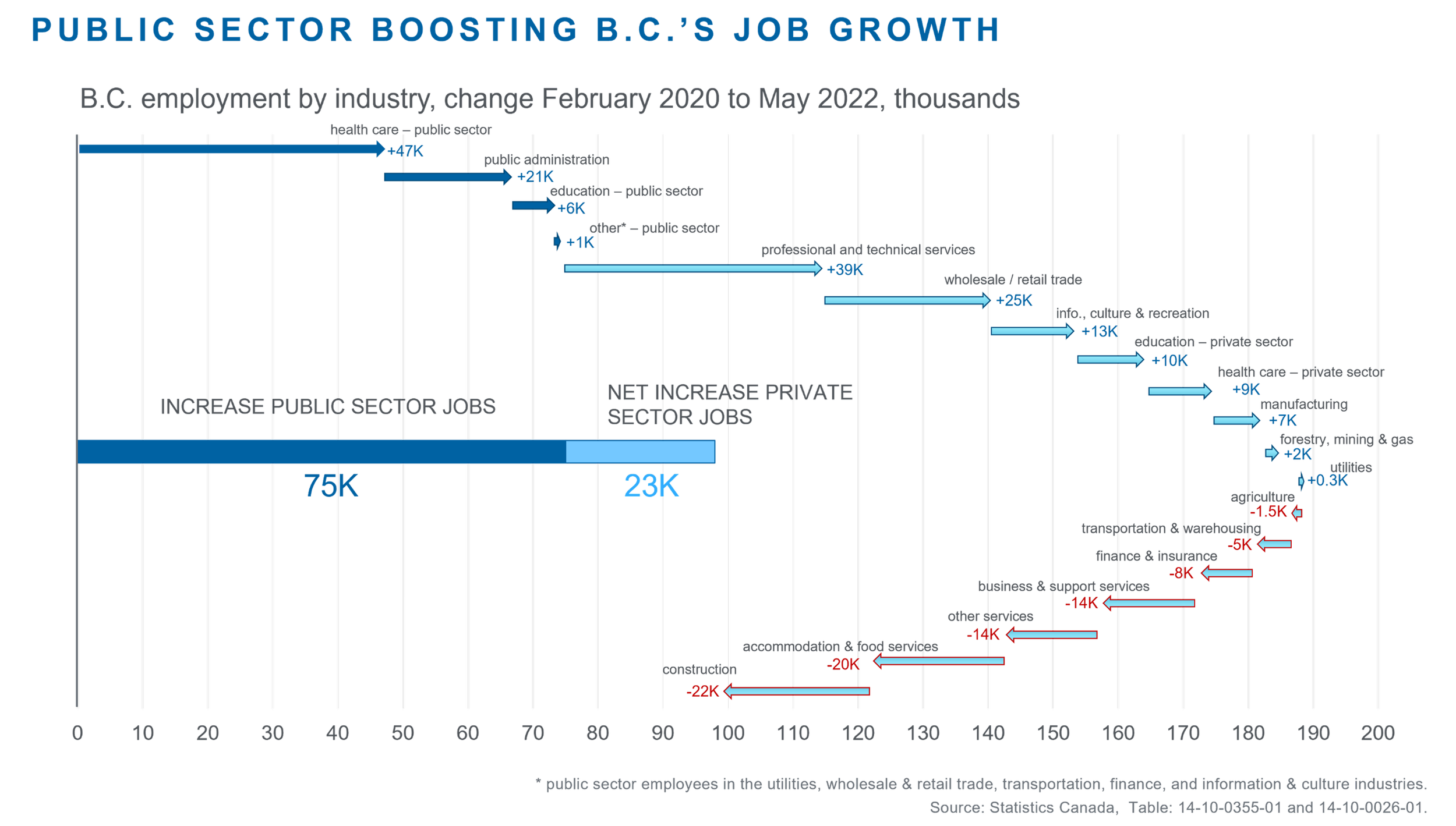

Over the past two years, B.C.’s job market has experienced once unimaginable job losses, a sharp if mixed rebound in employment, a longer period of more muted and sporadic employment growth, and lingering job losses in sectors most affected by COVID-related lockdowns and travel restrictions. In short, the province’s labour market has been through an unprecedented shock that resulted in an extraordinary amount of churn.More than 180,000 jobs have been created in B.C. since just prior to the pandemic. These are scattered across just nine industries and are heavily concentrated in six or seven. In the remining seven industries collectively, employment in B.C. is down ~ 85,000. Because of these job losses, total employment in the province is up a much more modest 98,000. A detailed breakdown of changes in employment is shown in the figure below, with the length of each arrow representing the number of jobs gained (blue) or lost (red) within each industry in the period since February 2020.

Figure 1

In addition to broad gain/loss dynamics, the figure reveals that the job gains that have materialized are unevenly distributed, ranging from +57,000 in health care to small increases in the forestry, mining and utilities industries. Job gains in just two industries – health care and professional and technical services – nearly equal aggregate net job growth, underscoring the point about the strong concentration of job creation since early 2020. Losses, too, are unevenly distributed, with the greatest numbers of displaced workers in the construction and accommodation and food services industries.

Tracking employment changes by industry also highlights the disproportionate role of the public sector in overall job creation in B.C. over the past 27 months. Health care, public administration, and education are among the top five industries based on the largest absolute job increases.[1]Collectively, employment gains in these public sector-oriented industries (and the small number of additional public sector jobs in other industries) add up to 75,000. If one views private sector job gains as basically offset by the lingering (and increasingly permanent) private sector job losses stemming from the pandemic, then public sector hiring accounts for three of every four jobs created in the province since February 2020.Figure 2 reorders the arrows shown in Figure 1 and darkens the ones representing public sector industries to make the point visually.

Figure 2

The table below contains the absolute employment changes (summarized in the above figures) and the employment growth rates for each industry. The number of people employed in each industry in February 2020 and May 2022 is also provided. Based on job growth rates (rather than absolute changes), public administration rises to the top of the industry rankings. Health care moves down to third spot, while education remains in fifth.The large public sector-oriented industries still occupy three of the top five spots, as in the absolute change rankings. But looking at growth rates serves to further underscore the prolific hiring within the broad public sector. Total public sector employment is up nearly 16% over the 27-month period. This means public sector employment has grown more quickly than employment in all other B.C. industries apart from professional, scientific and technical services. Employment across the private sector industries that have seen gains (the light blue arrows) is up 9%. Public sector hiring has grown at almost twice that pace. As detailed in the table, netprivate sector job growth in the province since February 2020 is just 1%.

Table 1

With the provincial unemployment rate hovering near record lows and the total number of people employed in the province up nearly 100,000 since the start of the pandemic, in aggregate the labour market has mostly recovered. But three of every four new jobs created in the province since the start of the pandemic have been in the public sector. As the final figure below shows, private sector employment (consisting of paid employees plus those who are self-employed) is well below its pre-pandemic growth trend. For a more complete and durable economic recovery, job creation in the private sector will need to accelerate. Relying on the public sector to drive and sustain employment growth is not a viable long-term strategy for the province.

Figure 3

[1] Approximately 45% of all jobs in the health care and social assistance industry are in the public sector; but public sector jobs account for 85% of all new jobs in the industry since February 2020. Close to 80% of education jobs are in the public sector but the public sector only accounts for 40% of new jobs. About 84% of all jobs in the utilities industry are public sector, but the industry is small and has limited impact on job creation. Smaller shares of public sector workers are found in transportation (~18%), finance (~7%), and information and culture (~10%); collectively these other industries account for ~1,000 of the total 75,000 public sector jobs created since February 2020.