What drives Canadian house prices?

Canada’s consumer price index (CPI) has long been systematically underestimating mortgage debt owed, and therefore mortgage interest costs incurred, by homeowners for their principal residence. A previous blog discussed Statistics Canada’s recent change to incorporate established house prices into the CPI’s “mortgage interest cost index” (MICI). BCBC advocated for this change in April 2018. As of February 2021, in tracking growth in mortgage debt outstanding for six major census metropolitan areas (CMAs), Statistics Canada will now assign around two-thirds weight on established house price growth (previously 0% weight) and one-third weight to new house price growth (previously 100%). The change is a positive step towards developing a CPI that better reflects the increasing costs of home ownership in Canada.

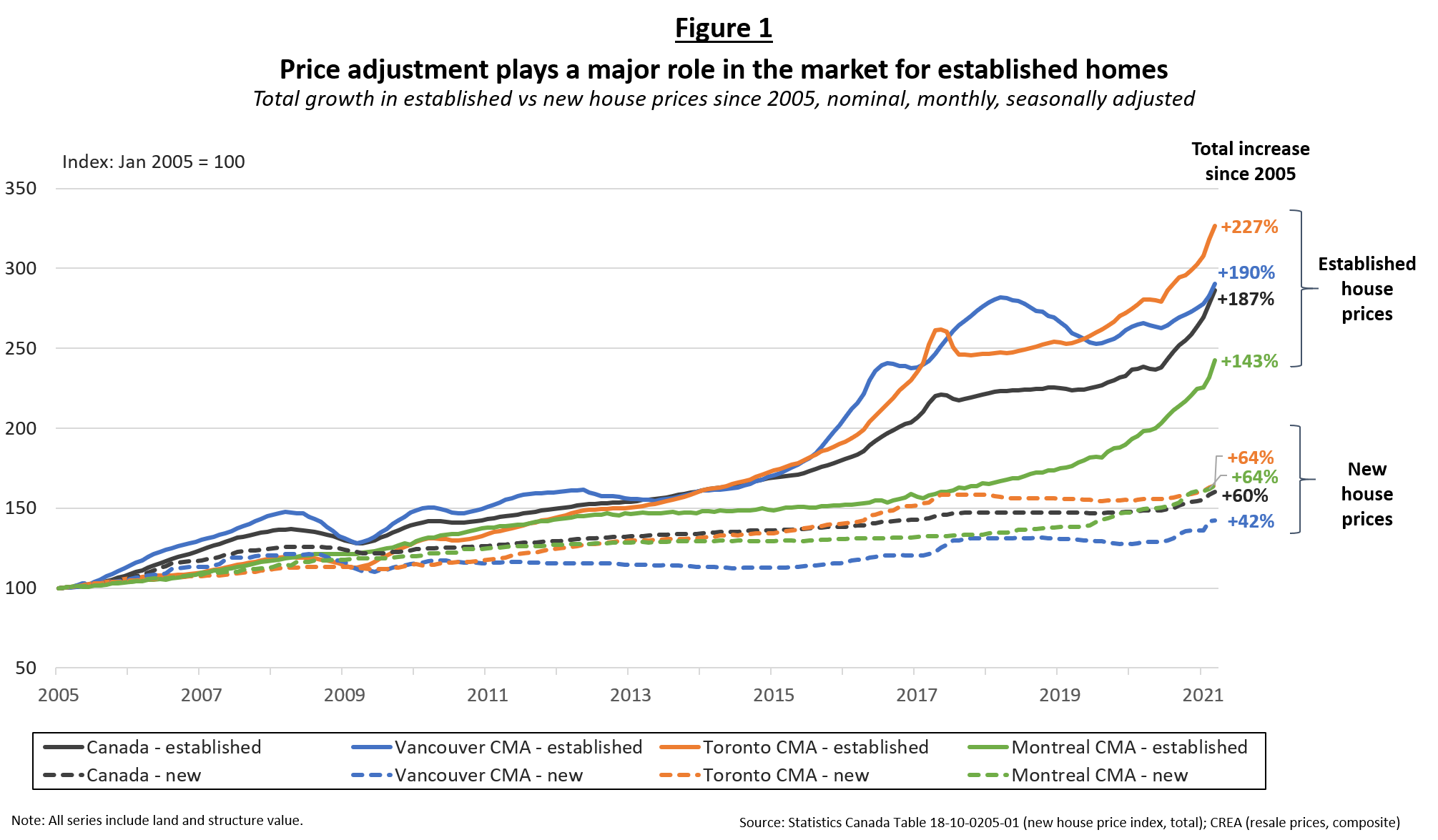

This blog will discuss why established and new house prices behave differently, especially in Canada’s land-constrained gateway cities. Figure 1 shows that since 2005 established house prices have risen by a total of 227%, 190% and 143% in the Toronto, Vancouver, and Montreal CMAs, respectively. Over the same period, new house prices saw a cumulative increase of only 64% in the Toronto and Montreal CMAs, and by 42% in the Vancouver CMA. For Canada as a whole, average established house prices have risen by 187% since 2005, whilst new house prices have risen only 60% over the same period. All series are inclusive of land and structure values. There are good reasons for the huge disparity between established and new home price growth: their prices are determined very differently.

What drives established house prices?

A 2015 Bank of Canada research paper by Muellbauer et al. (2015) theoretically and empirically examined the fundamentals that determine Canadian real established house prices over the long and short run. Established homes are bought and sold in a secondary asset or “resale” market – like the market for stocks of companies or that for precious metals. Established house prices are mostly determined by demand-side fundamentals, including changes in: nominal mortgage interest rates; inflation; the generosity of mortgage finance conditions (e.g. loan-to-value limits, mortgage default insurance terms, repayment-to-income limits and amortization limits set by lenders and government policies); buyers’ expectations for capital gains; household incomes; and immigration (mainly because newcomers tend to purchase in “gateway cities” which are already innately land-constrained). Many of these demand-side fundamentals, especially the credit-related ones, are largely “unbounded” – meaning that they can change significantly and quickly. A real-time example was seen during the COVID-19 pandemic of 2020, when mortgage interest rates abruptly fell by half resulting in sudden, spectacular nation-wide increases in established house prices.

The opposite is true for established housing supply. In determining the market-clearing or equilibrium price for established homes over the long run, housing “supply” is the stock or total number of houses that already exist (including land, with the structure value adjusted for constant quality and depreciation). It is a simple reality that new home construction (net of demolitions) adds only tiny increments – only about 1-3% per year – to the existing housing stock each year. In fact, Muellbauer et al. (2015) tested and found that the rate of new home construction has statistically zero impact on Canadian real established house price growth over periods of 5 years or less.

Housing “supply” is only materially increased after many years of accumulated new construction (net of demolitions). Even in the long run, and even with high rates of new building, accumulated increases in the housing stock tend to be modest compared to shifts in housing demand (e.g. increases in the stock of mortgage debt) over the same period. Long term increases in the housing stock tend to be especially modest in geographically-constrained major cities because – by their very nature – these municipalities do not have large tracts of greenfield land to release. Land volume growth is intrinsically constrained, and land values tend to contribute more to a home’s total value than its structure cost. In such cities, new home construction tends to take the form of brownfield land development, in-fill and densification, and changes in land use tend to be subject to significant municipal scrutiny and debate because of the innate scarcity of land.

The overall result is that established housing supply barely changes in the short run, so it simply cannot rebalance the market after sudden increases in demand for established homes. All of the imbalance caused by increases in established housing demand must be met by price adjustment (and especially the landvaluecomponent of house prices). Muellbauer et al. (2015) found that established house prices in Canada adjust to changes in housing demand and supply fundamentals within about 5 years, which is consistent with the typical refinancing horizon of Canadian mortgages.

For example, the authors found that if prevailing mortgage interest rates were to fall by 25 basis points, Canadian real established house prices would increase by around 5% over the following 5 years, all else being equal. During the 2020 pandemic, mortgage interest rates abruptly dropped by six times that amount (i.e. around 150 basis points)! All else being equal, the results of Muellbauer et al. (2015) would suggest that nationwide real established house prices will rise by roughly 30% over 2020-2025. Sure enough, national established house prices are so far up about 18% in real terms over the year to March 2021.

In summary, increases in established house prices over a short period can be interpreted as entirely demand-driven. Demand-side fundamentals are also the main driver of established house prices over the long run. This is especially the case in land-constrained gateway cities where increases in the housing stock (and land volumes in particular) tend to be modest compared to increases in housing demand (especially mortgage demand) over the same period. This is the main explanation for established house price dynamics in Canada’s major cities over the past two decades.

What drives new house prices?

In contrast, new homes are bought and sold in a primary asset market. In the new home market, "supply” consists of completed construction units plus any previously completed homes yet to be sold by developers (known as “unabsorbed inventory”). To a significant degree, new home prices are a function of supply-side fundamentals, including: land acquisition, finance and holding costs; construction materials, labour and finance costs; and municipal government levies on building and new development. In contrast to established homes, structure costs may represent a larger share of a new home’s total value compared to land values since new land tends to be cheaper and/or located further from the city centre.

New home prices also depend on the developer’s profit margin or mark-up, which may fluctuate depending on new housing demand (i.e. what the market will bear). Since new and established homes are close substitutes, increased demand for new homes tends to coincide with increased demand (and, for the reasons discussed above, price increases) for established homes. Increased demand for new housing leads to higher mark-ups on new development, which incentivizes new construction activity. The result is that some of the increase in new housing demand can be met by an increase in new home building and new land release, which helps to alleviate the pressure on new home prices. This is quite different to the market for established homes, where prices have to do all or most of the work in adjusting to increased demand because supply responses are innately non-existent in the short term and modest even in the long term.

Conclusion

Established and new home prices are driven by different fundamentals and evolve in very different ways. Previously, the mortgage interest cost component of the CPI assumed Canadians were paying interest on mortgages that were increasing in line with the value of newly built homes. This approach significantly underestimated the increase in mortgage sizes over time, and which has contributed to the rise in established house prices over the past two decades, especially in Canada’s gateway cities. Statistics Canada’s recent change to the CPI is a positive step towards developing a CPI that better reflects the increasing costs of home ownership in Canada.

Further reading:

Muellbauer, J., St-Amant, P. and D. Williams. 2015. “Credit conditions and consumption, house prices and debt: What makes Canada different?” Bank of Canada Staff Working Paper 2015-40.

Williams, D. 2018. “How do house prices affect the consumer price index?” Insights, Business Council of British Columbia, April 24.