Sticker Shock: Broad-Based Inflation Strains B.C. Households

Media kit & graphs: https://bit.ly/3Xf4Ufl

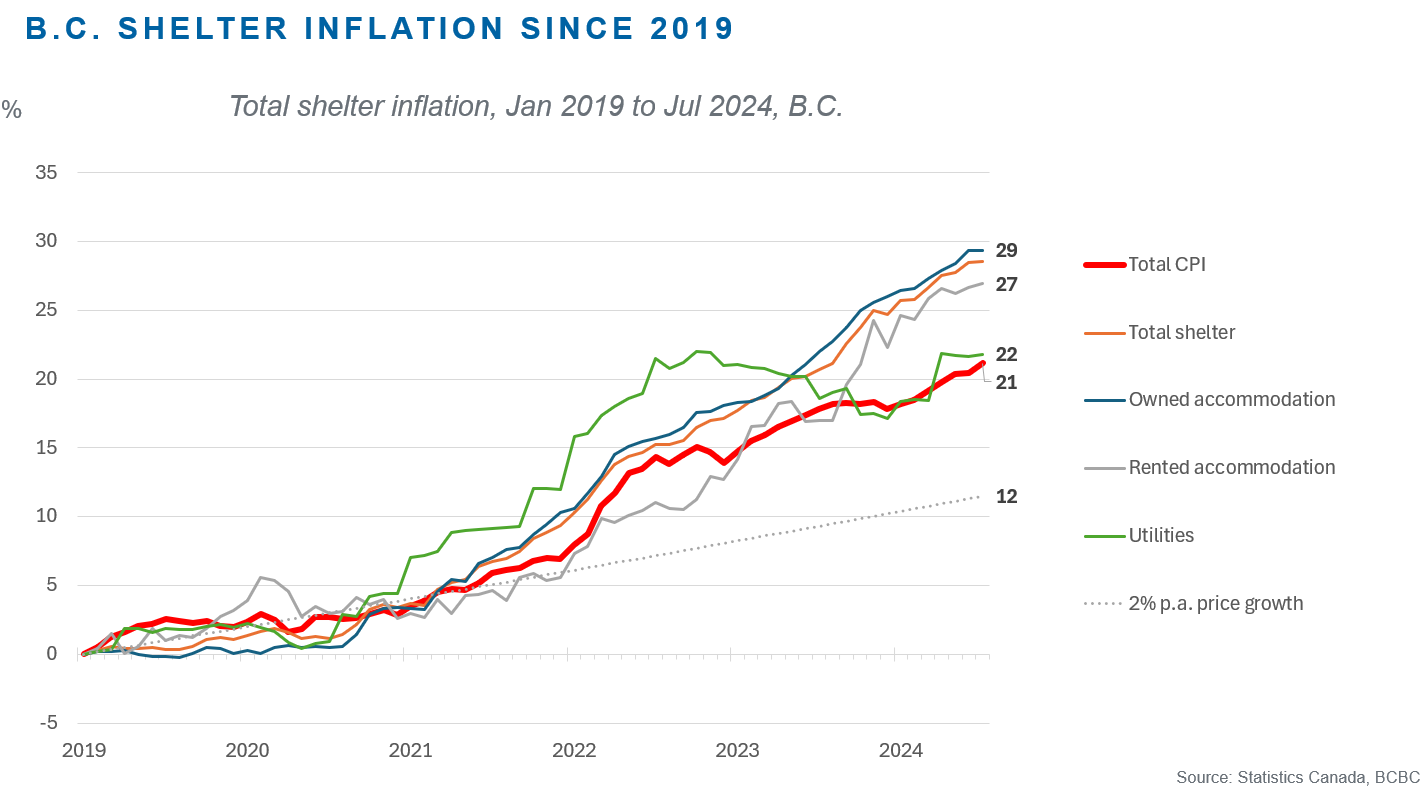

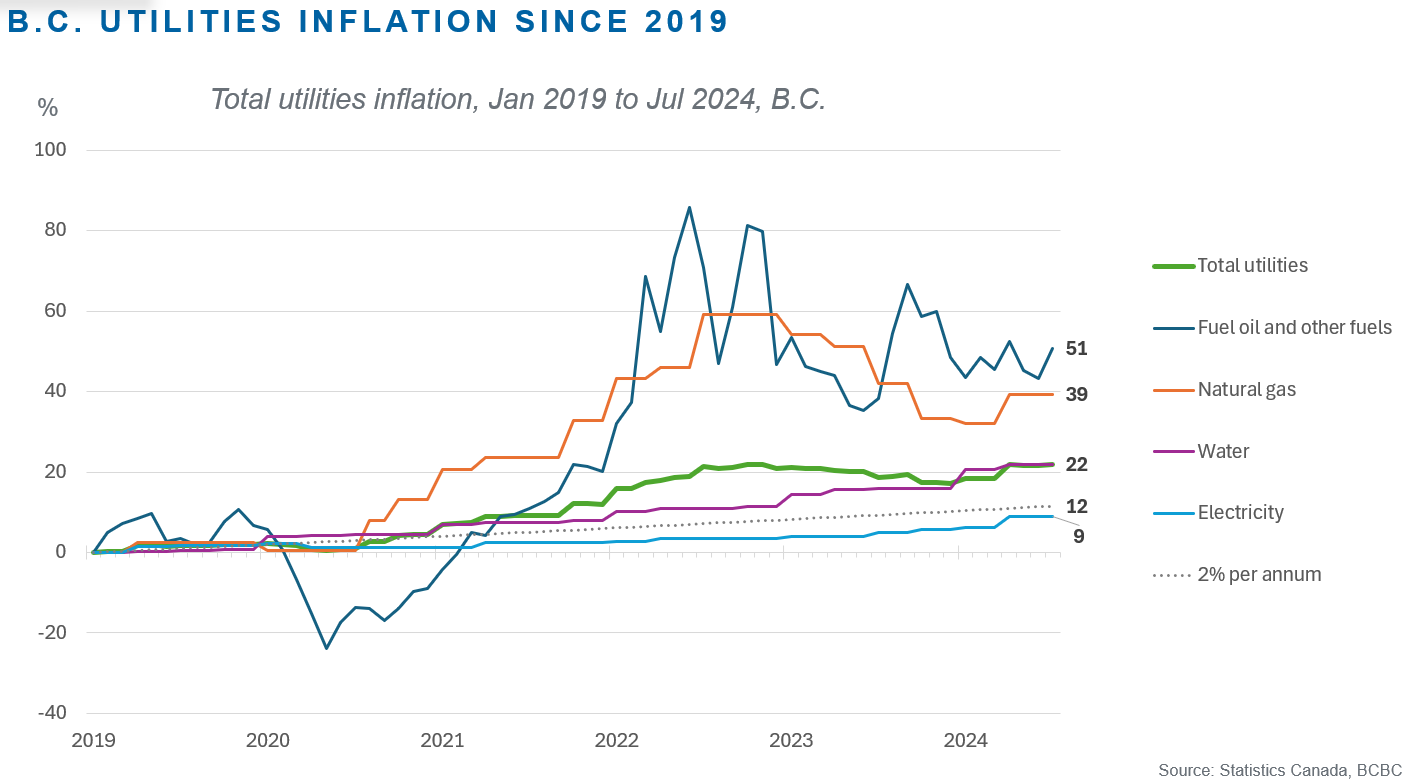

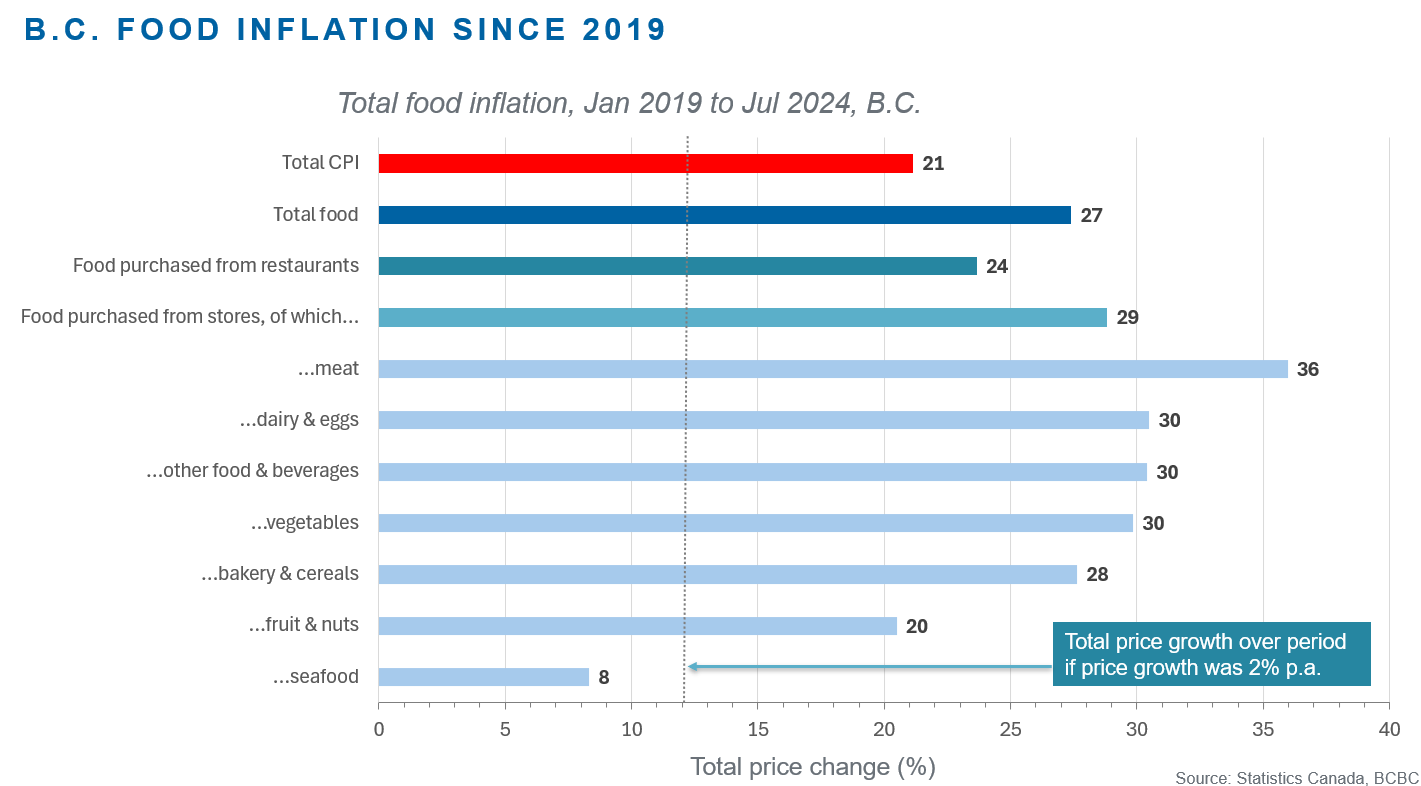

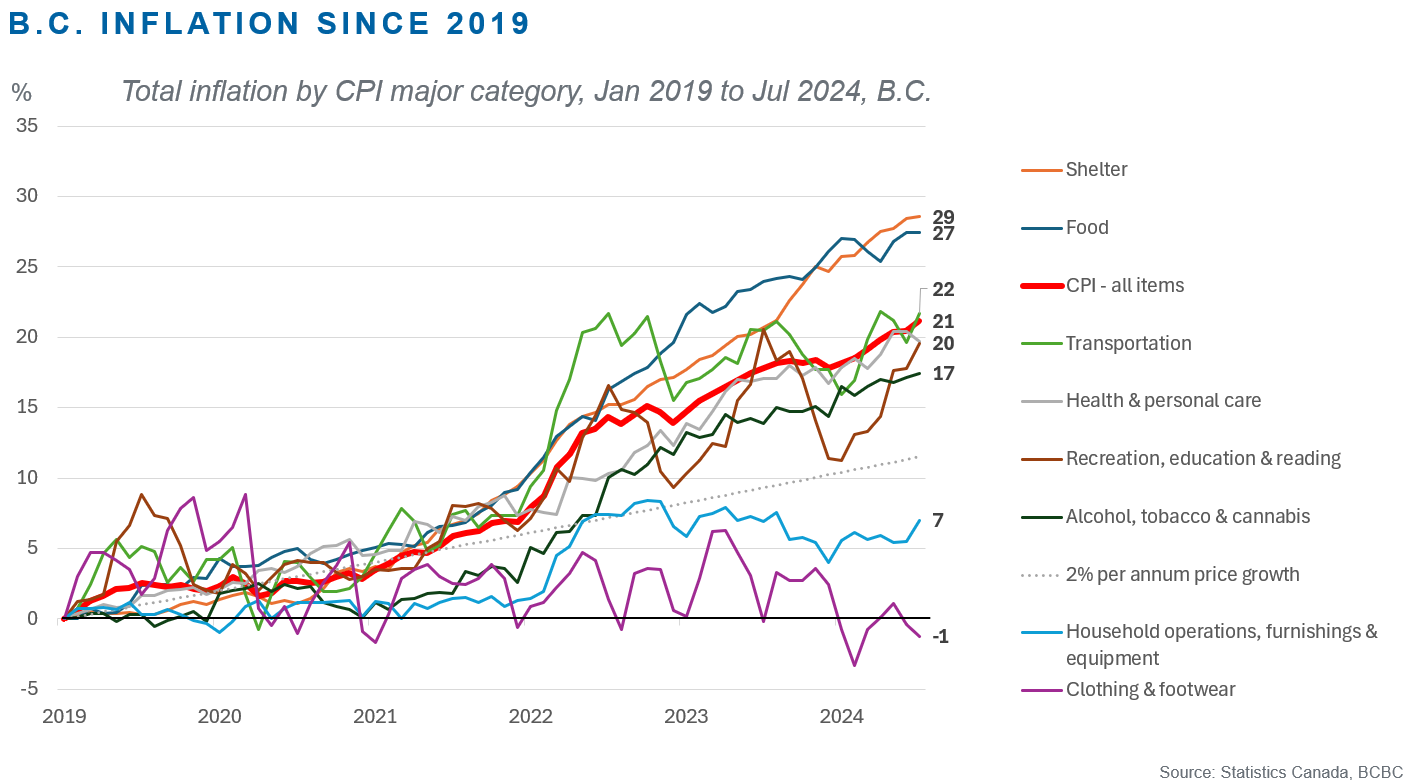

Vancouver, B.C. – A new analysis from the Business Council of British Columbia (BCBC), as part of its Sticker Shock series, highlights a sustained and excessive rise in the cost of living across the province. According to the series, it costs the average consumer 21 per cent more to live in B.C. than it did in January 2019. Necessities like shelter and food have seen particularly sharp price increases of 29 and 27 per cent, respectively, since 2019.

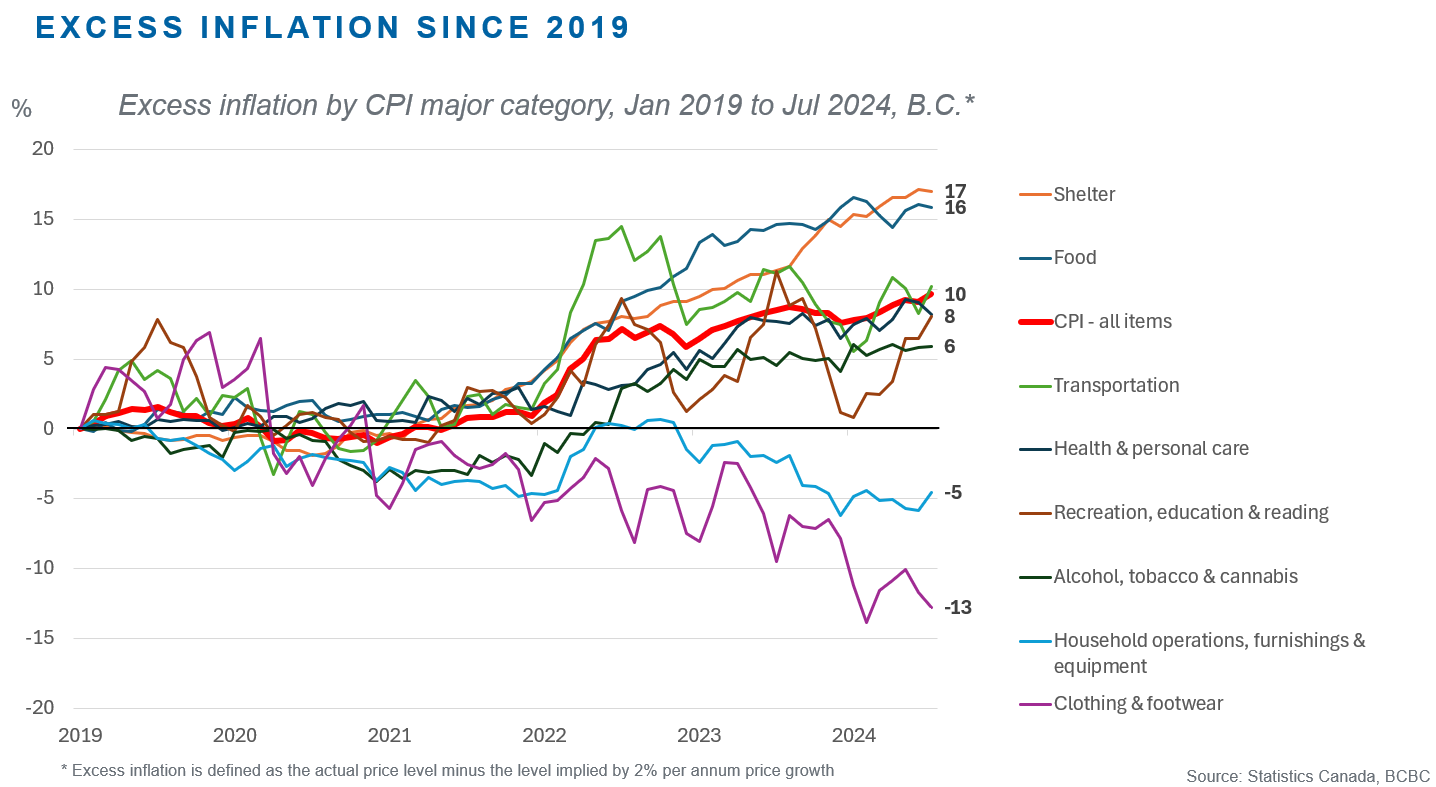

The analysis, based on data from Statistics Canada's Consumer Price Index (CPI), reveals that six out of eight major product categories in B.C. have seen prices rise faster than the Bank of Canada's two per cent per annum target for national CPI inflation.

The findings are timely as British Columbians gear up for the October provincial election, with 66 per cent of respondents in a recent Angus Reid poll identifying “Cost of living/Inflation” as their top concern.

"British Columbians and Canadians more broadly are grappling with the effects of significant price increases across nearly every facet of life," says David Williams, VP of Policy at BCBC. "As political parties prepare for the provincial election, it's crucial they focus on policies that help ease cost-of-living pressures. A good place to start is fiscal discipline."

According to Williams, fiscal discipline is important to help ease cost-of-living pressures and avert further downgrades by international credit ratings agencies. As the province’s credit worthiness declines, it costs more to borrow to fund government operating deficits and capital plans.

Williams also emphasizes that now is not a good time for governments to stoke demand.

“B.C.’s annual inflation is running at the second highest in Canada at 2.8 per cent as of July. The projected provincial budget deficit for this fiscal year is 1.9 per cent of GDP, which is larger than the deficit of 1.8 per cent of GDP recorded in 2020/21 during the COVID-19 emergency. The unemployment rate was 13.3 per cent during COVID-19 compared to 5.5 cent now, so it’s hard to justify injecting emergency-levels of fiscal stimulus into today’s economy.”

The Sticker Shock series, available on the BCBC website, takes stock of the price increases experienced by British Columbians over the past five years.

Fast Facts:

Overall, consumer prices in B.C. have risen by a total of 21% since January 2019.

B.C. has the second highest annual inflation rate nationally at 2.8% as of July 2024.

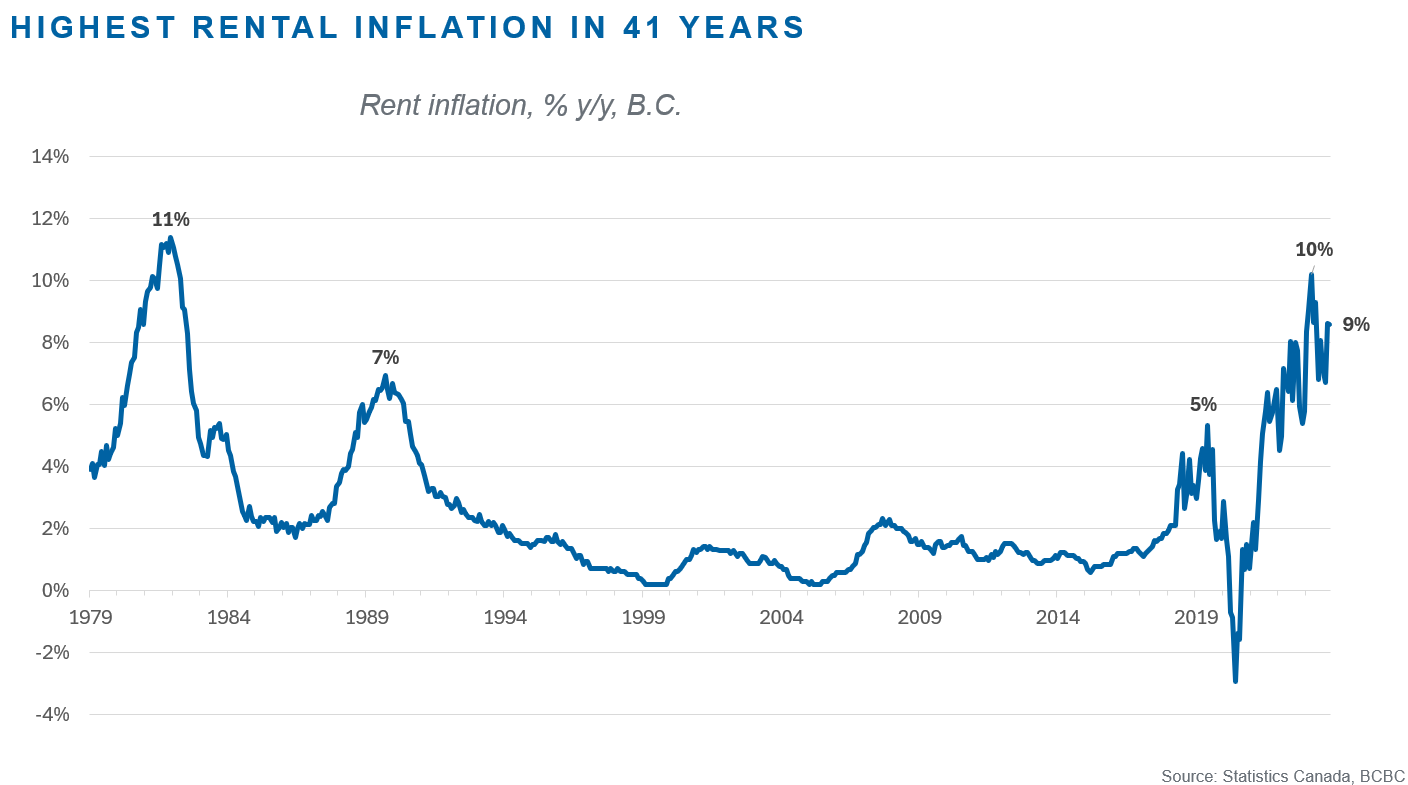

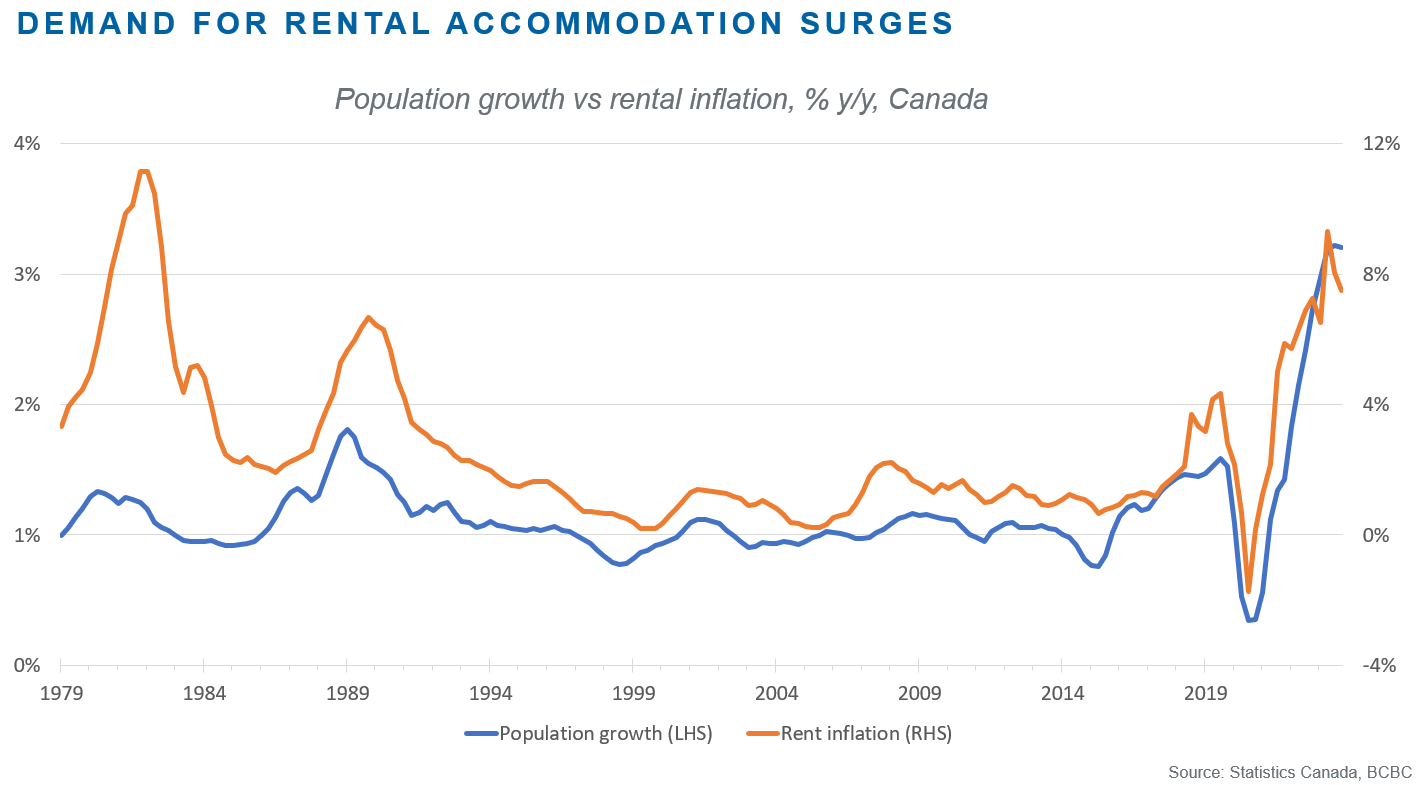

Rental accommodation costs have soared by 27% since January 2019 at the fastest pace of rental inflation in 41 years.

There have been significant increases in home and mortgage insurance costs (49%) and property taxes (33%) since January 2019.

Food inflation since January 2019 has been high across grocery categories: meat (36%), dairy products and eggs (30%), other foods and non-alcoholic beverages (30%), vegetables (30%).

According to data from Food Banks Canada, there were nearly 200,000 visits to B.C. food banks in 2023. This represents a 57% increase in the number of people visiting food banks between 2019 and 2023.

Market renters, children, people living on government supports, single people, and immigrants living in Canada for less than 10 years are overrepresented at visits to B.C. food banks.

Media contact:

Braden McMillan, Director of Communications | braden.mcmillan@bcbc.com

About BCBC

Established in 1966, the Business Council of British Columbia is a non-partisan organization dedicated to promoting prosperity for current and future generations.

Comprised of over 200 leading B.C. companies, post-secondary institutions and industry associations, BCBC provides credible information, fosters cross-sectoral relationships and advocates for bold and practical solutions to the policy challenges of our time.