A snapshot of B.C.'s exports in 2022

Last month’s B.C. Budget noted that solid export growth helped to keep the province’s economy on a firm recovery track in 2022. The value of the province’s merchandise exports jumped almost 20% in the first half of the year, before softening over the second half. For calendar 2022, merchandise exports reached $64.4 billion, up more than $10 billion from the year before. Energy exports soared by 56% in 2022, while exports of solid wood products fell by more than 10% and those of mineral product exports were down 5% from 2021.On the services side, B.C. tourism exports increased last year but remain well below pre-COVID levels. Most other categories of international service exports – including technology services, education services, professional and technical services, and transportation services – also enjoyed decent gains last year. The (inflation-adjusted) real value of B.C.’s exports of goods and services combined grew by 6.3% in 2022.[1]

This contributed to the overall 3% advance in the province’s real GDP last year. It is instructive to do a deeper dive into the province’s exports. A forthcoming BCBC research paper will do just that, exploring the evolution of goods and services exports in a detailed review of the key export sectors underpinning B.C.’s prosperity. Below, I provide an overview of what’s been happening to the province’s merchandise exports, taking advantage of an update recently published by the B.C. government.[2]

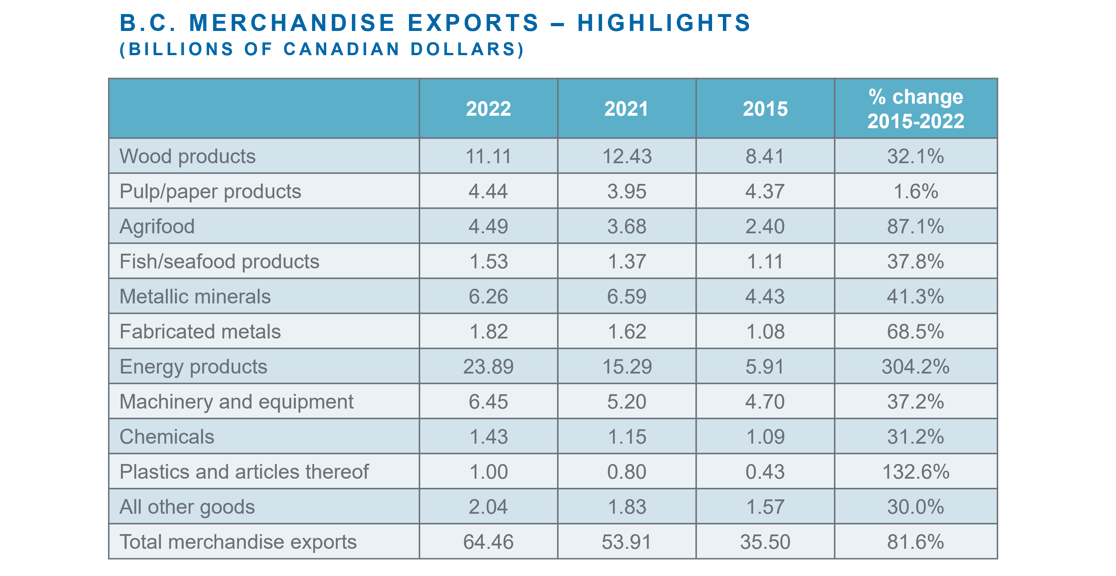

Table 1 shows the value of B.C. merchandise exports by broad industry sector in 2022 as well as 2021, along with the percentage change since 2015. Charts 1 and 2 show the destination of the province’s goods exports in 2015 and 2022.

Total merchandise exports jumped by 82% between 2015 and 2022.

Energy products made up a remarkable 37% of British Columbia’s goods exports last year, up from just 17% back in 2015. This mainly reflects high prices for both natural gas and coal in 2022. Coal and natural gas dominate the province’s foreign energy sales, with coal being the single largest export.[3]In nominal dollar terms, B.C.’s energy exports surged more than 300% between 2015 and 2022.

Wood products and machinery and equipment were the second and third largest broadly defined export sectors in 2022, followed by metallic mineral products, agri-food and pulp and paper.

All major export sectors except wood products and metallic mineral products generated higher year-over-year receipts in 2022 compared to the prior year, with energy and machinery and equipment posting particularly impressive percentage increases.

Over the period 2015 to 2022, the biggest export gains, in percentage terms, were in the following broad sectors: energy, plastics, agrifood, and fabricated metals.

Looking at the foreign markets B.C. sells to, there have been only modest changes since the middle of the 2010s. Over the 2015-2022 period, the U.S. remained by far the most important export market, with China and Japan consistently ranking second and third. Note that China’s share of B.C. exports in 2022 was depressed owing to that country’s severe COVID-related restrictions over most of the year.

[1] B.C. Budget, February 28, 2023, p. 93.

[2] BC Stats, “Annual B.C. Origin Exports,” February 7, 2023.

[3] The vast majority of coal produced in B.C. is metallurgical coal used in steel-making.

Total merchandise exports jumped by 82% between 2015 and 2022.

Energy products made up a remarkable 37% of British Columbia’s goods exports last year, up from just 17% back in 2015. This mainly reflects high prices for both natural gas and coal in 2022. Coal and natural gas dominate the province’s foreign energy sales, with coal being the single largest export.[3]In nominal dollar terms, B.C.’s energy exports surged more than 300% between 2015 and 2022.

Wood products and machinery and equipment were the second and third largest broadly defined export sectors in 2022, followed by metallic mineral products, agri-food and pulp and paper.

All major export sectors except wood products and metallic mineral products generated higher year-over-year receipts in 2022 compared to the prior year, with energy and machinery and equipment posting particularly impressive percentage increases.

Over the period 2015 to 2022, the biggest export gains, in percentage terms, were in the following broad sectors: energy, plastics, agrifood, and fabricated metals.

Looking at the foreign markets B.C. sells to, there have been only modest changes since the middle of the 2010s. Over the 2015-2022 period, the U.S. remained by far the most important export market, with China and Japan consistently ranking second and third. Note that China’s share of B.C. exports in 2022 was depressed owing to that country’s severe COVID-related restrictions over most of the year.

[1] B.C. Budget, February 28, 2023, p. 93.

[2] BC Stats, “Annual B.C. Origin Exports,” February 7, 2023.

[3] The vast majority of coal produced in B.C. is metallurgical coal used in steel-making.