B.C. Business Confidence Survey - Q4 2022

The Business Council of British Columbia’s B.C. Business Confidence Survey canvasses the views of senior decision-makers at 50 large and leading companies operating in the province. The survey asks about firms’ outlook for their: sales growth, investment and hiring plans; outlook for the provincial economy; views about provincial government policies; and outlook for inflation and wage growth.

Highlights

B.C.’s economy is headed for marked slowdown in 2023, according to BCBC’s third survey of large and leading businesses in the province. The survey canvasses the views of 50 major employers sampled in accordance with the industrial composition of B.C.’s business sector GDP.

On balance, B.C.'s large firms expect slower sales growth over the next 12 months compared to the previous 12 months. While sales growth will be cooler, it will remain positive.

Hiring plans are robust, suggesting B.C.’s labour market will remain overstimulated and overheated in the near term. However, plans to increase capital investment are less widespread. Firms appear to be relying more on hiring additional labour, rather than making capital investments, to expand output and meet expected sales growth over the next 12 months.

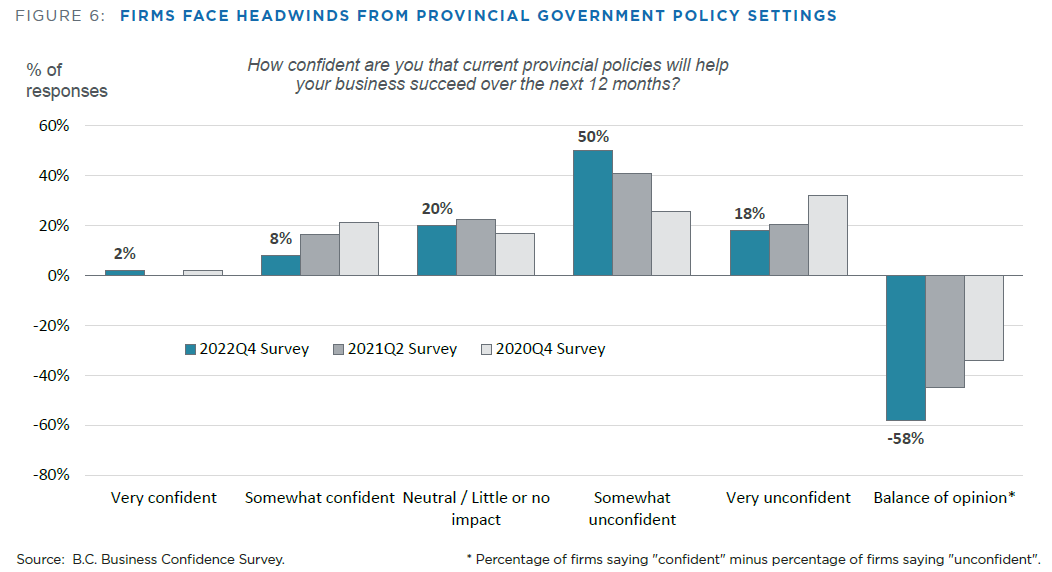

Around two-thirds of firms believe a recession in B.C. is highly likely or likely in 2023, while a further quarter see it as somewhat likely. Business leaders expressed deteriorating confidence that the current policy settings of the provincial government will help their businesses succeed over the next 12 months. Taken together, the results suggest business leaders see a potential recession looming while being saddled with largely unfavourable policy settings for conducting commerce and operating large businesses in the province.

Firms expect CPI inflation and wage inflation to average 5.0% and 6.1% per annum over the next two years, respectively. This implies real wage growth for employees working at large firms of 1.1% per annum over the next two years, on average. Notably, this is slightly above the 0.9% per annum average pace of labour productivity and real product wage growth across Canada over 2000-2019. Thus, large firms appear to be expecting positive real wage growth to resume, after a period of falling real wages since 2019.

This is BCBC’s third B.C. Business Confidence Survey. Previous surveys were conducted in 2021Q2 and 2020Q4. The latest results should be interpreted with caution. There were no responses from firms in the wholesale and retail trade sectors, which represent about 8% of the target sample. To achieve 50 responses, the survey includes some modest oversampling of manufacturing firms relative to their weight in provincial business sector GDP. The survey was conducted from October 26 to November 24, 2022.