The calm before the storm – Canadian household debt servicing ratios are set to rise

Canadian households are among the most indebted in the world (Williams, 2021a). They should brace themselves for a new era of rising interest rates. Few borrowers have experienced such an environment in the past forty years. Since the early 1980s, borrowers have come to rely on a long, downward trend in both nominal and real (after-inflation) interest rates. However, in many advanced countries, especially in the United States (see Cochrane (2022)) and also Canada, CPI inflation rates are now the highest since the early 1980s due in no small part to ultra-loose fiscal and monetary policies that were sustained for more than a year longer than was necessary to fight the COVID-19 pandemic.Central banks are belatedly scrambling to scale back stimulus for their overheated economies. Fiscal policymakers have been even slower to react but will soon be forced to start taking fiscal discipline more seriously (again, see Cochrane (2022)). Voters will not allow governments to spend far more than they raise in taxes while the inflation dragon wreaks havoc on people’s purchasing power and standard of living (Williams 2021b and Williams 2021c). This sets up a difficult adjustment for Canadian households.

How have record low interest rates affected household debt servicing ratios?

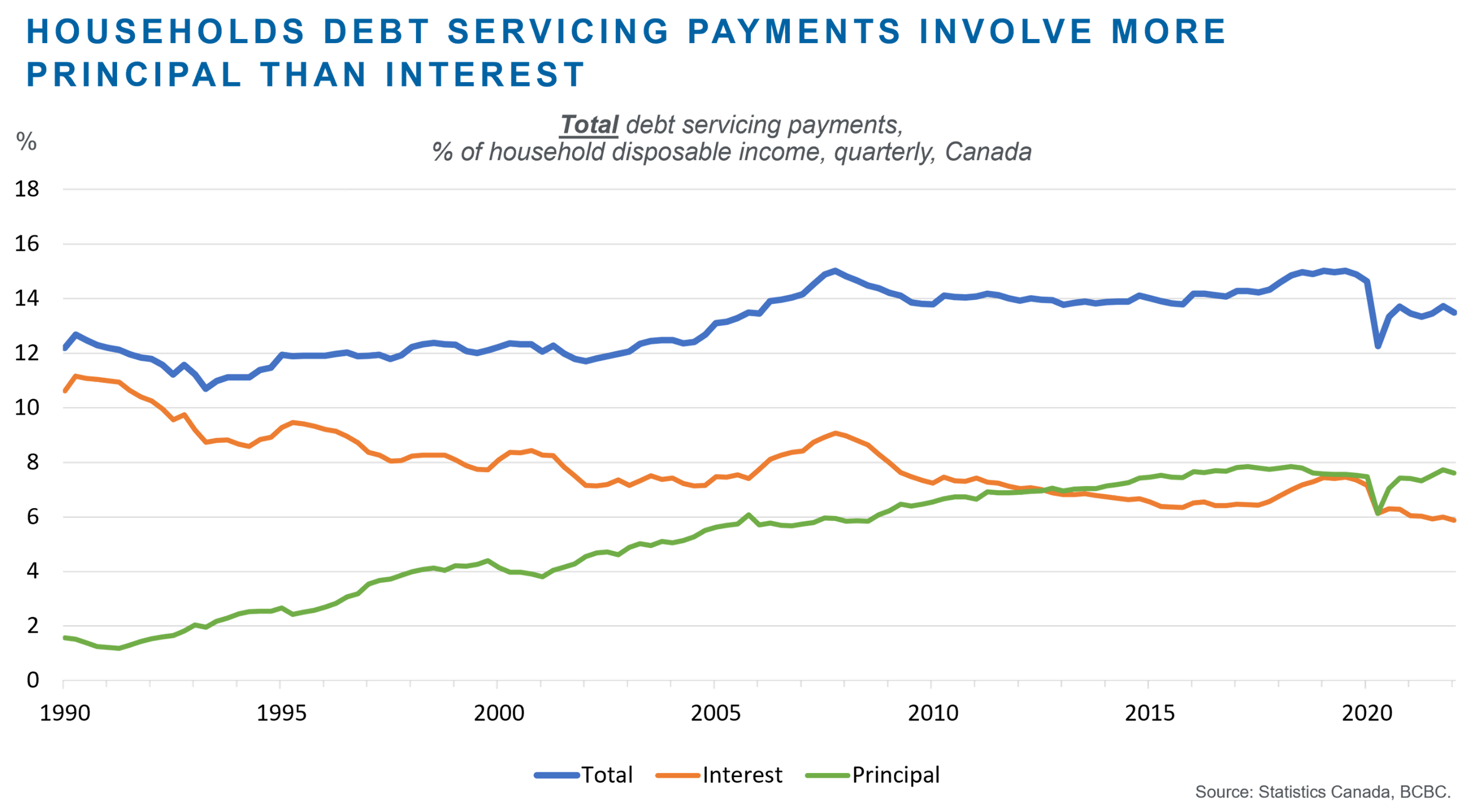

Figures 1-3 show Canadian households’ debt servicing ratios (DSRs), where debt service payments are expressed as a percentage of household disposable income (i.e., household market income net of government taxes and transfers). The DSR on total household debt is elevated, despite exceptionally low-interest rates in recent years, because borrowers responded to rock bottom interest rates by taking on larger loans. Principal payments surpassed interest payments as a percentage of income in about 2012 (Figure 1). The overall household DSR also reflects a rising mortgage DSR (Figure 2) partly offset by a falling non-mortgage DSR (Figure 3).

Figure 1

Mortgage debt constitutes the lion’s share of overall household debt. Mortgage principal payments surpassed interest payments as a percentage of household disposable income during 2016-17 and from 2021 (Figure 2). Principal payments on mortgage debt are a record high share of income. Conversely, interest payments on mortgage debt are near record lows. As interest rates rise, the interest payment component will increase - and the increase will likely be substantial. This will likely push the mortgage DSR, and therefore the overall household DSR, to new highs. Higher interest payments will likely also crowd out discretionary consumer spending (especially on big-ticket durable goods) and home renovation spending.

Figure 2

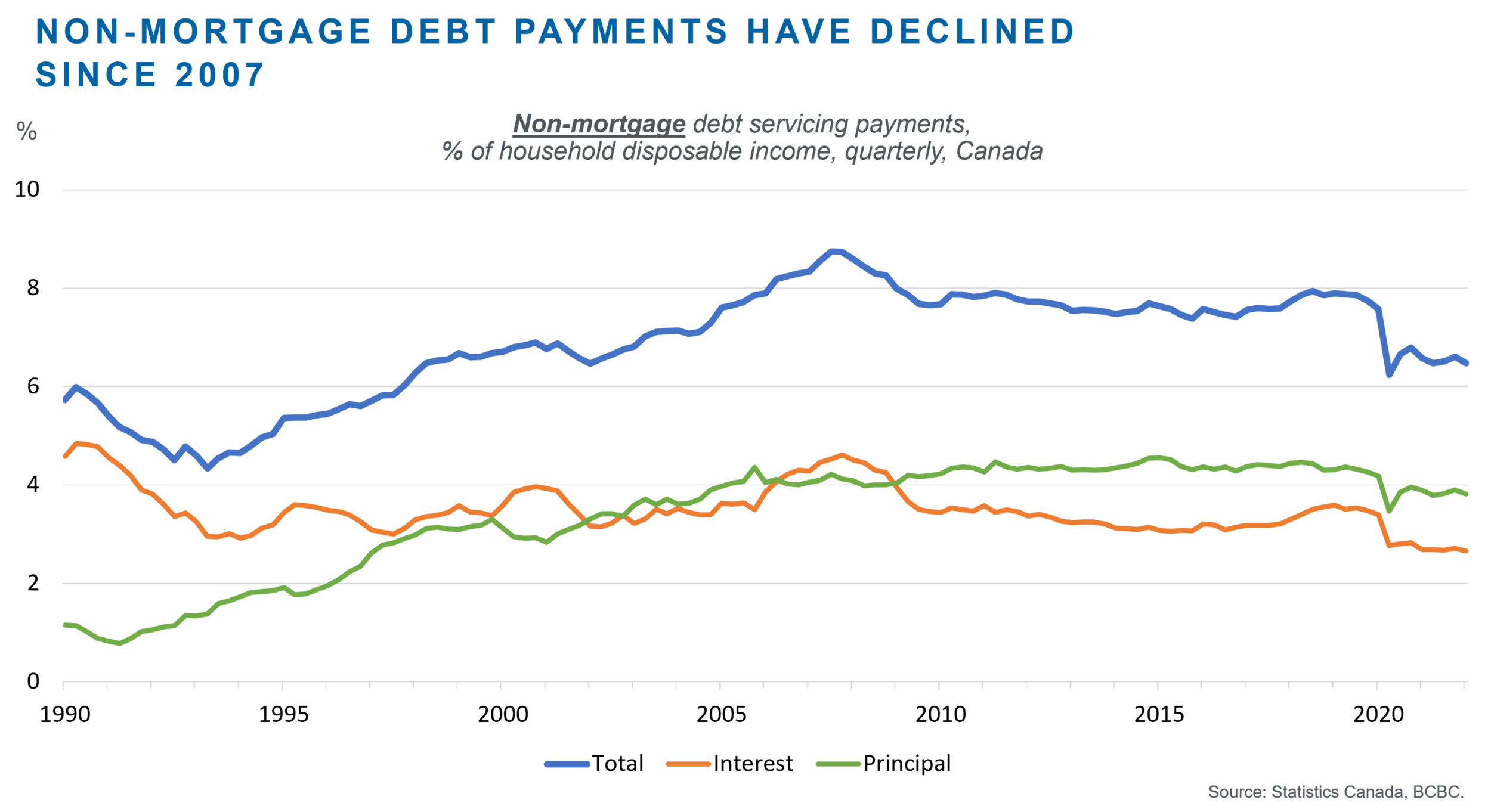

For consumer debt (i.e., non-mortgages), principal payments exceeded interest payments as a share of household disposable income during 2002-06 and after 2009 (Figure 3). Again, the interest component will increase going forward.

Figure 3

What is the outlook for debt servicing ratios?

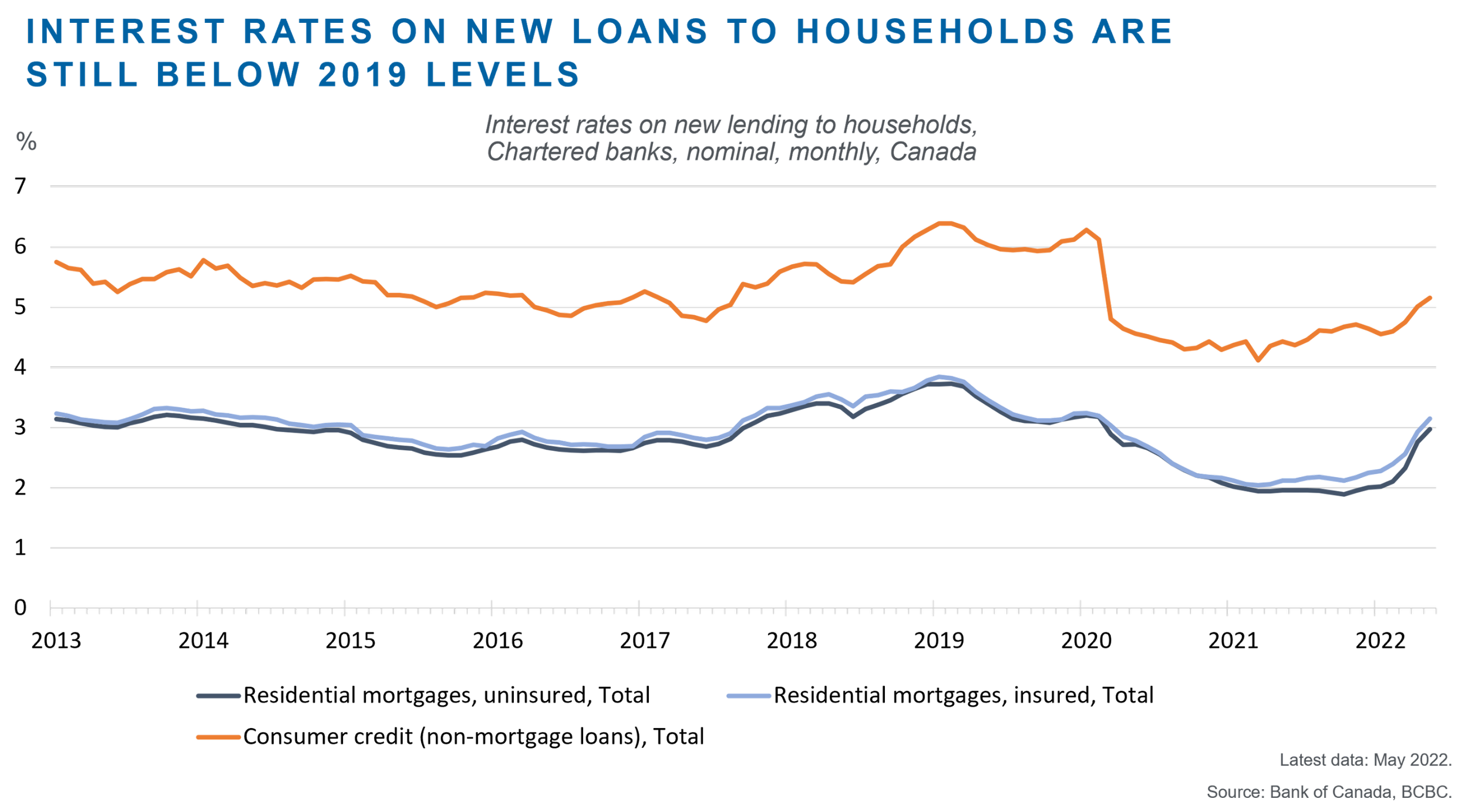

The overall household DSR, the mortgage DSR and the non-mortgage DSR will all rise as global interest rates increase. And they will rise even further as household disposable income growth slows. The process is only just beginning. As at June 2022, chartered bank interest rates facing households on new funds advanced were still below 2019 levels (i.e., before the pandemic, when CPI inflation was around the Bank of Canada’s 2% target).Canada’s mortgage stock adjusts to changes in interest rates over a horizon of about 5 years because the vast majority of mortgages require refinancing at or within 5 years (Muellbauer et al. 2015). This suggests the mortgage interest DSR, and therefore the total mortgage DSR, will materially rise over 2022-23 through to 2027-28.

Figure 4

Conclusion

For Canadian households, the shift in global monetary and fiscal policy from ultra-easy to neutral, and then neutral to tight, could be tectonic. If Canada’s economy tips into recession in coming quarters, it will not be like the recessions of 2000, 2008 and 2020. On those occasions, central banks were like swashbuckling Hollywood movie heroes riding to the rescue by slashing policy interest rates and (in 2008 and 2020) hoovering up government bonds and other credit instruments through quantitative easing.The potential economic downturn from late 2022/early 2023 until perhaps 2024 will have more in common with the recession of the early 1990s. Central banks, including the Bank of Canada, will not be able to let up on contractionary monetary policy until the inflation dragon has been beaten back into its lair.

This sets up a painful adjustment for Canada’s credit-dependent economy. No longer can growth in households’ disposable incomes be propped up by debt-financed government transfers and falling interest costs on households’ loans (Williams and Finlayson, 2022). Growth in household income will need to come from faster labour productivity growth and will be supported by the favourable shift in Canada’s external terms of trade that has been evident in 2021-22 (Williams, 2021d).Policymakers in Ottawa and Victoria must pay more attention to strengthening the supply side of the economy instead of being preoccupied with stimulating demand. They should review and reduce the structural inefficiencies and disincentives facing businesses in expanding the economy’s productive capacity. All else being equal, higher household income growth – the denominator of the DSR – would help to soften the impending jump in household debt servicing ratios amid rising interest rates.