Where does taxpayers' money go? It's hard to say. Canada and B.C. governments receive failing grades on fiscal transparency

Canadians pay a lot of taxes: personal income taxes, corporate income taxes, sales taxes, carbon taxes, capital gains taxes, withholding taxes, carbon and fuel excise taxes, property transfer taxes, customs duties, tobacco and liquor taxes, user fees and charges. The list goes on. Meanwhile, total government spending across Canada averaged $28,000 per capita in 2020/21, up from $21,000 per capita in 2019/20 (see Williams, 2022), having increased in response to the COVID-19 pandemic. In 2021/22, spending by all levels of government was still high at more than $26,000 per capita.

It all adds up. Or does it? Where does the money come from? Where does it go? What is it used for? And most importantly, is that money better in people’s pockets – where it can be spent in our communities, or saved for the future – or in the government’s coffers?

It turns out, Canadians can’t be sure.

A new report by the C.D. Howe Institute assesses the fiscal transparency of the federal and provincial governments (Robson and Dahir, 2022). The authors examine governments’ budgets and financial statements from 2019 to 2022 and give annual letter grades on their overall fiscal transparency based on four criteria (see below).

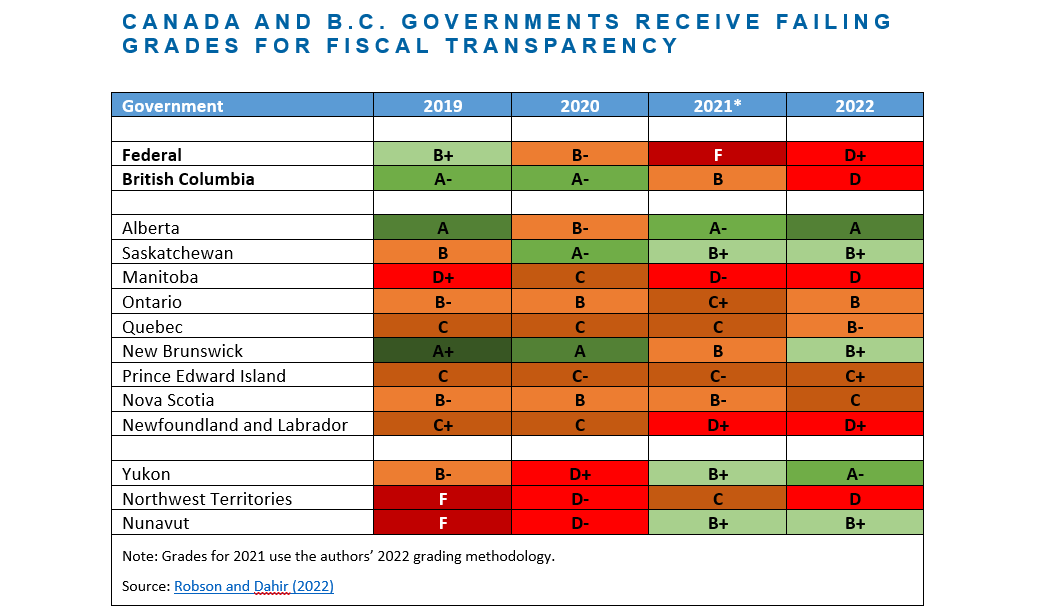

Canada and B.C. governments receive failing grades on fiscal transparency

The federal and British Columbia governments are at the back of the class in 2022, receiving failing grades of “D+” and “D”, respectively (Table 1). Both governments are on a downward track and are headed for difficult conversations at the next parent-teacher interview. The federal government received an even worse grade of “F” for 2021 mainly because, incredibly, it did not produce a budget at all! This is shocking because the federal government is expected to show leadership in fiscal accountability, not drag down the class average through its truancy. Yes, the COVID-19 pandemic was a global catastrophe. But to our knowledge Canada was the only country in the world where the national government decided to skip producing a budget because of it. Canada’s parliament simply rubber-stamped the government’s (massive) tax and spending proposals with little oversight or scrutiny – or much idea of where the money was being spent.

Table 1

The authors of the C.D. Howe paper offer the following comments on the federal government’s report card for 2022 (Robson and Dahir, 2022: p15):

“The federal government’s budget was late and buried the key numbers. It released its main estimates separately from the budget. Although the federal government received a clean audit opinion, the release of its public accounts was delayed by a reopening of the books to backdate some spending after the auditor general had already signed off – an unprecedented move that led us to deduct a point on that criterion. The federal government’s financial statements have recently highlighted a presentation without a figure for consolidated expense, showing actuarial losses related to its employee pensions below a conceptual “operational balance” line. This presentation implies that these actuarial losses resulted from circumstances outside the government’s control, which is misleading: they reflect the government’s use of an artificially high discount rate when it originally recorded the pension obligations (Laurin and Robson 2020). Although this amount appears in consolidated expenses, with other costs of federal employees, in some parts of the public accounts, its omission in the highlighted figures lowered the federal government’s grade.”

The authors wrote the following on the B.C. government’s report card for 2022 (Robson and Dahir, 2022: p16):

“British Columbia was an A-level performer in the past, but has slipped lately. The size of the discrepancy flagged by its auditor general is an ongoing problem, as is its below-the-line adjustment. A late budget that did not highlight consolidated revenue and expense and a large contingency reserve also contributed to a poorer grade this time.”

Meanwhile, the class valedictorian for 2022 is Alberta. Yukon is a close second. The Alberta government received an “A,” building on similarly high grades in previous years. Saskatchewan and New Brunswick also scored reasonably well in 2022. Both received a “B+”. Other provinces and territories were graded as middling to poor in fiscal transparency. There is considerable room for improvement.

At the top of the class, Alberta’s report card for 2022 reads as follows (Robson and Dahir, 2022: p10):

“Alberta received an A grade and Yukon received an A-. Alberta was one of only two governments to release its public accounts within 90 days of year-end. Both Alberta and Yukon presented numbers early in their documents. Both used consistent accounting, and Yukon used consistent aggregation across all three documents. Both tabled budgets and estimates simultaneously before the start of the fiscal year. Both published in-year updates.”

Methodology

To develop their fiscal transparency scorecard, the authors put themselves in the mind of a non-expert reader of government budget plans and financial statements. The authors graded governments on several criteria:

Timeliness – fiscal documents should be released in a timely fashion so that elected parliamentarians have full information to debate and make good decisions about tax and spending proposals.

Placement of key metrics – they should be easy to find and identify in the documents. Readers should not have to wade through reams of “extraneous or potentially misleading material” (in other words, “puffery” or “spin”).

Reliable and transparent numbers – readers should be able to easily find consolidated revenues, consolidated expenses, and the budget surplus or deficit. Also, the accounts should have been signed off by the Auditor General without qualification. In other words, an independent, expert statutory officer is willing to certify that there is no “funny business” going on in the accounting.

Comparability of numbers – readers should be able to easily compare current budget statements with previous years’ financial statements.

Conclusion

The last word should go to the authors (Robson and Dahir, 2022):

“Canada’s senior governments raise and spend huge amounts, and have legally unlimited capacity to borrow when their expenses exceed their revenues. Holding public officials accountable for their spending, taxing and borrowing is a foundational task in a system of representative government. Citizens have the right to know, and elected representatives have duties to them.

While much of the financial information presented to legislators and the public by Canada’s federal, provincial and territorial governments has improved over time, the C.D. Howe Institute’s 2022 report card reveals shortfalls. Too many governments present information that is opaque, misleading and late.

Canada’s federal, provincial and territorial governments loom large in the Canadian economy and in Canadians’ lives. Even before COVID-19 prompted major increases, their budgets and spending estimates for the 2021/22 fiscal year prefigured more than $1 trillion in revenue and expense – around 41 percent of gross domestic product, or more than $26,000 per Canadian.

They use this money to provide services and transfer payments in areas such as health, education, national defence and policing, income support and business subsidies. They tax Canadians’ incomes from work and saving, and they tax spending on most goods and services. Over time, their aggregate expenses have exceeded their revenues, resulting in negative net worth. At the end of the 2020/21 fiscal year, their accumulated deficits totaled $1.4 trillion and, during that year, they paid more than $49 billion in interest.

Taxpayers’ and citizens’ ability to monitor, influence and react to how legislators and officials manage public funds is fundamental to representative government. We need to check that legislators and government officials are acting in the interest of the people they represent, and we need to respond if we conclude that they are acting negligently or in their own interest. Financial reports are key tools for monitoring governments’ performance of their fiduciary duties.”

References

Laurin, A. and W. B. P. Robson. 2020. “Under the rug: The pitfalls of an “operating balance” approach for reporting federal employee pension obligations.” C.D. Howe Institute, E-Brief no. 309, November 24.

Robson, W. B. P. and N. Dahir. 2022. “The right to know: Grading the fiscal transparency of Canada’s senior governments, 2022.” C.D. Howe Institute, Commentary no. 628, September 15.